In a world when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Whether it's for educational purposes project ideas, artistic or simply adding an individual touch to your space, How Many Years Do I Keep Receipts For Taxes have become an invaluable resource. With this guide, you'll take a dive into the sphere of "How Many Years Do I Keep Receipts For Taxes," exploring the different types of printables, where to find them, and how they can enrich various aspects of your lives.

Get Latest How Many Years Do I Keep Receipts For Taxes Below

How Many Years Do I Keep Receipts For Taxes

How Many Years Do I Keep Receipts For Taxes -

Verkko 7 helmik 2022 nbsp 0183 32 Rebecca Garland on February 7 2022 As a business owner you know that you need to keep a document trail for tax purposes But what exactly do you need to keep If you re doing your best to keep every single receipt just in case you can relax

Verkko 28 lokak 2022 nbsp 0183 32 The IRS recommends keeping returns and other tax documents for three years or two years from when you paid the tax whichever is later The IRS has a statute of limitations on conducting

The How Many Years Do I Keep Receipts For Taxes are a huge variety of printable, downloadable material that is available online at no cost. They are available in a variety of forms, like worksheets templates, coloring pages and many more. The value of How Many Years Do I Keep Receipts For Taxes lies in their versatility as well as accessibility.

More of How Many Years Do I Keep Receipts For Taxes

How To Keep Receipts Organized For Taxes

How To Keep Receipts Organized For Taxes

Verkko 10 marrask 2023 nbsp 0183 32 Freelancers often think they need physical receipts for every single tax deduction That s actually a myth To debunk it we re going straight to the source the IRS The IRS says to keep records for your business tax deductions indicating What you bought When you bought it How much you spent And guess what

Verkko 27 tammik 2017 nbsp 0183 32 Keep tax related records for seven years McBride recommended The Internal Revenue Service IRS can audit you for three years after you file your return if it suspects a good faith error and the IRS has six years to challenge your return if it thinks you underreported your gross income by 25 percent or more according to

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

The ability to customize: We can customize print-ready templates to your specific requirements in designing invitations or arranging your schedule or even decorating your home.

-

Educational value: Printing educational materials for no cost can be used by students of all ages. This makes them a great tool for teachers and parents.

-

Accessibility: Fast access numerous designs and templates, which saves time as well as effort.

Where to Find more How Many Years Do I Keep Receipts For Taxes

7 Tips For Keeping Receipts Organized For Tax Time

7 Tips For Keeping Receipts Organized For Tax Time

Verkko 25 helmik 2022 nbsp 0183 32 Keep for less than a year In this file Weltman says to store your ATM bank deposit and credit card receipts until you reconcile them with your monthly statements Once you ve done that

Verkko 15 kes 228 k 2014 nbsp 0183 32 The IRS can randomly audit you three years after you file or six years afterward if it thinks you skipped out on reporting your income by at least 25 Year end account statements These

Now that we've piqued your interest in How Many Years Do I Keep Receipts For Taxes and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection and How Many Years Do I Keep Receipts For Taxes for a variety motives.

- Explore categories such as decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- These blogs cover a broad spectrum of interests, that range from DIY projects to planning a party.

Maximizing How Many Years Do I Keep Receipts For Taxes

Here are some inventive ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

How Many Years Do I Keep Receipts For Taxes are an abundance of practical and innovative resources that meet a variety of needs and interests. Their availability and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the vast collection of How Many Years Do I Keep Receipts For Taxes today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes, they are! You can download and print these tools for free.

-

Can I utilize free printables for commercial use?

- It's all dependent on the rules of usage. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright problems with How Many Years Do I Keep Receipts For Taxes?

- Certain printables might have limitations in their usage. You should read the conditions and terms of use provided by the designer.

-

How can I print printables for free?

- You can print them at home using printing equipment or visit an area print shop for higher quality prints.

-

What software do I need to run printables that are free?

- Most printables come in PDF format. They can be opened with free software like Adobe Reader.

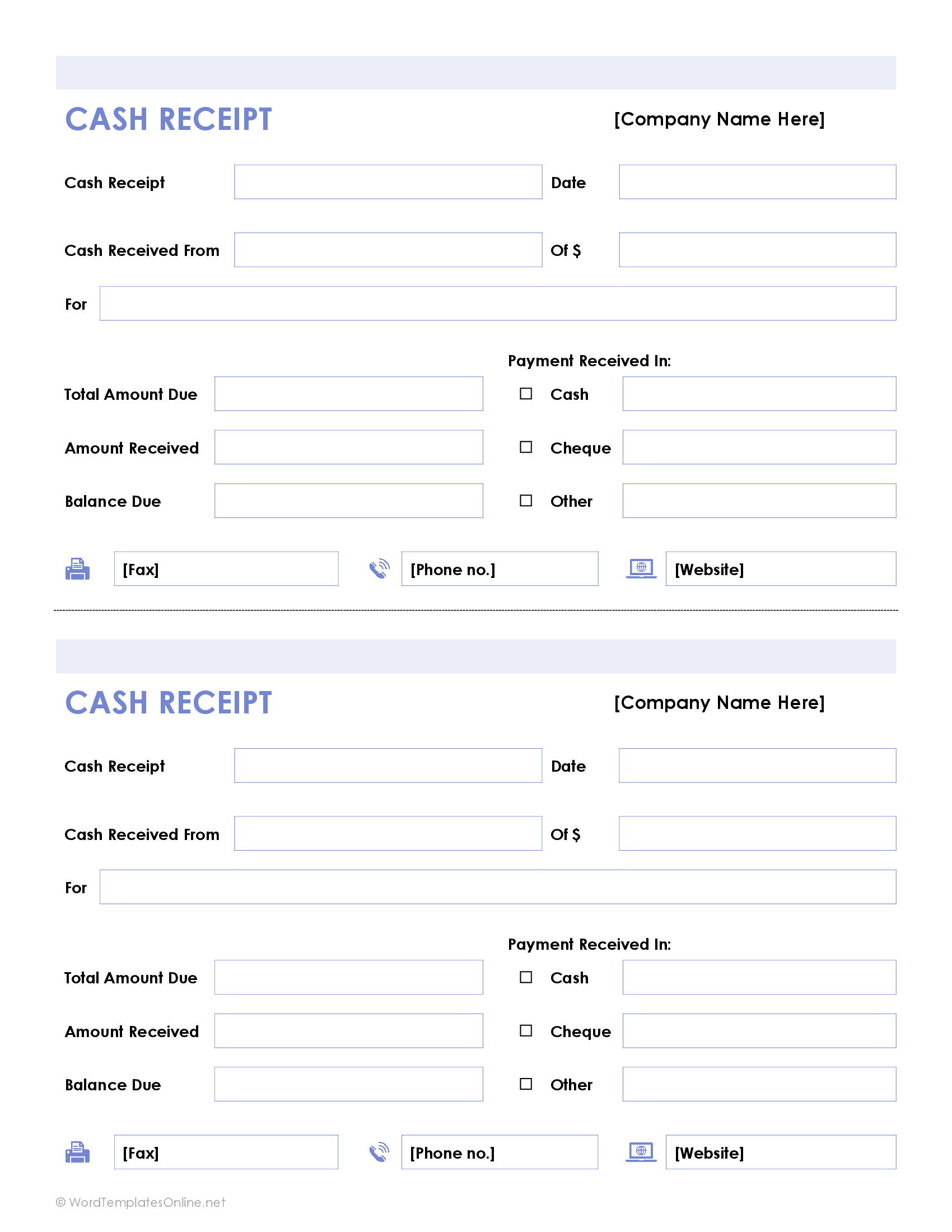

Receipts For Taxes Small Business Receipts To Keep

How Long Should I Keep Receipts For Tax Purposes No More Than Six

Check more sample of How Many Years Do I Keep Receipts For Taxes below

Organizing Receipts For Tax Time Mom Needs Chocolate

Keep Your Receipts

Or Receipt Sample Hq Printable Documents Free Nude Porn Photos

What Receipts Should I Keep For My Taxes Loans Canada

![]()

Free Printable Payment Receipt Form Images And Photos Finder

Should I Keep Receipts And For How Long

https://www.forbes.com/advisor/taxes/how-long-do-you-keep-tax-records

Verkko 28 lokak 2022 nbsp 0183 32 The IRS recommends keeping returns and other tax documents for three years or two years from when you paid the tax whichever is later The IRS has a statute of limitations on conducting

https://taxscouts.com/blog/do-you-need-to-keep-receipts-for-tax-purposes

Verkko 18 jouluk 2020 nbsp 0183 32 The rule of thumb is to keep receipts for five years if you re a sole trader six years if you re a limited company But in general it s probably just best to just keep them indefinitely A backed up hard drive will be your best friend and is much more reliable than overflowing folders shoved in a cupboard somewhere speaking from

Verkko 28 lokak 2022 nbsp 0183 32 The IRS recommends keeping returns and other tax documents for three years or two years from when you paid the tax whichever is later The IRS has a statute of limitations on conducting

Verkko 18 jouluk 2020 nbsp 0183 32 The rule of thumb is to keep receipts for five years if you re a sole trader six years if you re a limited company But in general it s probably just best to just keep them indefinitely A backed up hard drive will be your best friend and is much more reliable than overflowing folders shoved in a cupboard somewhere speaking from

What Receipts Should I Keep For My Taxes Loans Canada

Keep Your Receipts

Free Printable Payment Receipt Form Images And Photos Finder

Should I Keep Receipts And For How Long

How Long Should I Keep HSA Receipts Stop Ironing Shirts

These Are The Receipts To Keep For Doing Your Taxes GOBankingRates

These Are The Receipts To Keep For Doing Your Taxes GOBankingRates

Payment Receipt Format In Excel Excel Templates