In this day and age where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. Whether it's for educational purposes for creative projects, simply to add an individual touch to your home, printables for free have become an invaluable source. With this guide, you'll dive into the world of "How Long Must You Keep Records For Tax Purposes," exploring what they are, how to find them, and the ways that they can benefit different aspects of your life.

Get Latest How Long Must You Keep Records For Tax Purposes Below

How Long Must You Keep Records For Tax Purposes

How Long Must You Keep Records For Tax Purposes - How Long Must You Keep Records For Tax Purposes, How Long Do You Keep Records For Tax Purposes, How Long Should I Keep Records For Tax Purposes, How Long Do You Need To Keep Records For Tax Purposes, How Long Do You Need To Keep Records For Tax Purposes Ireland, How Long Should I Keep Business Records For Tax Purposes, How Long Do I Have To Keep Records For Tax Purposes, How Long Do You Need To Keep Business Records For Tax Purposes, How Long Do You Need To Keep Medical Records For Tax Purposes, How Long Do You Have To Keep Records For Income Tax Purposes

After filing your tax return organize and keep records for 3 6 7 or more years depending on statutes of limitations when the IRS may ask for them

How long must you keep your records Self employed or in partnership You have to keep your records for at least five years from 31 January following the tax year that the tax return relates

Printables for free cover a broad collection of printable materials available online at no cost. They are available in numerous kinds, including worksheets coloring pages, templates and much more. The attraction of printables that are free is their flexibility and accessibility.

More of How Long Must You Keep Records For Tax Purposes

How Long Should You Keep Financial Records

How Long Should You Keep Financial Records

You should keep your records for at least 22 months after the end of the tax year the tax return is for Example If you send your 2023 to 2024 tax return online by 31 January 2025 keep

A fringe benefits tax return is generally 3 years from your date of lodgment You need to keep your records long enough to cover the 5 year retention period and the period of

How Long Must You Keep Records For Tax Purposes have garnered immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Individualization Your HTML0 customization options allow you to customize print-ready templates to your specific requirements in designing invitations, organizing your schedule, or even decorating your house.

-

Education Value Free educational printables provide for students of all ages, making them an essential tool for parents and teachers.

-

An easy way to access HTML0: instant access a variety of designs and templates helps save time and effort.

Where to Find more How Long Must You Keep Records For Tax Purposes

How Long Must You Keep Receipts And Why

How Long Must You Keep Receipts And Why

If you run a business you must keep certain records for tax purposes Your records can be used to confirm information contained in your tax returns and they should

Personal pay and tax records you must keep to fill in a Self Assessment tax return which records to keep how long to keep records

We hope we've stimulated your curiosity about How Long Must You Keep Records For Tax Purposes Let's take a look at where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection with How Long Must You Keep Records For Tax Purposes for all motives.

- Explore categories such as interior decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free as well as flashcards and other learning tools.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- These blogs cover a broad variety of topics, everything from DIY projects to party planning.

Maximizing How Long Must You Keep Records For Tax Purposes

Here are some new ways that you can make use use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home or in the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

How Long Must You Keep Records For Tax Purposes are a treasure trove of creative and practical resources that satisfy a wide range of requirements and hobbies. Their availability and versatility make them an essential part of both professional and personal lives. Explore the vast array of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes you can! You can download and print the resources for free.

-

Can I use the free printouts for commercial usage?

- It's dependent on the particular conditions of use. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright rights issues with How Long Must You Keep Records For Tax Purposes?

- Certain printables may be subject to restrictions regarding usage. You should read the terms and conditions provided by the creator.

-

How can I print printables for free?

- Print them at home using a printer or visit any local print store for more high-quality prints.

-

What software is required to open printables at no cost?

- Most printables come with PDF formats, which is open with no cost software, such as Adobe Reader.

ASDA VAT Receipt FAQS For Business Explained

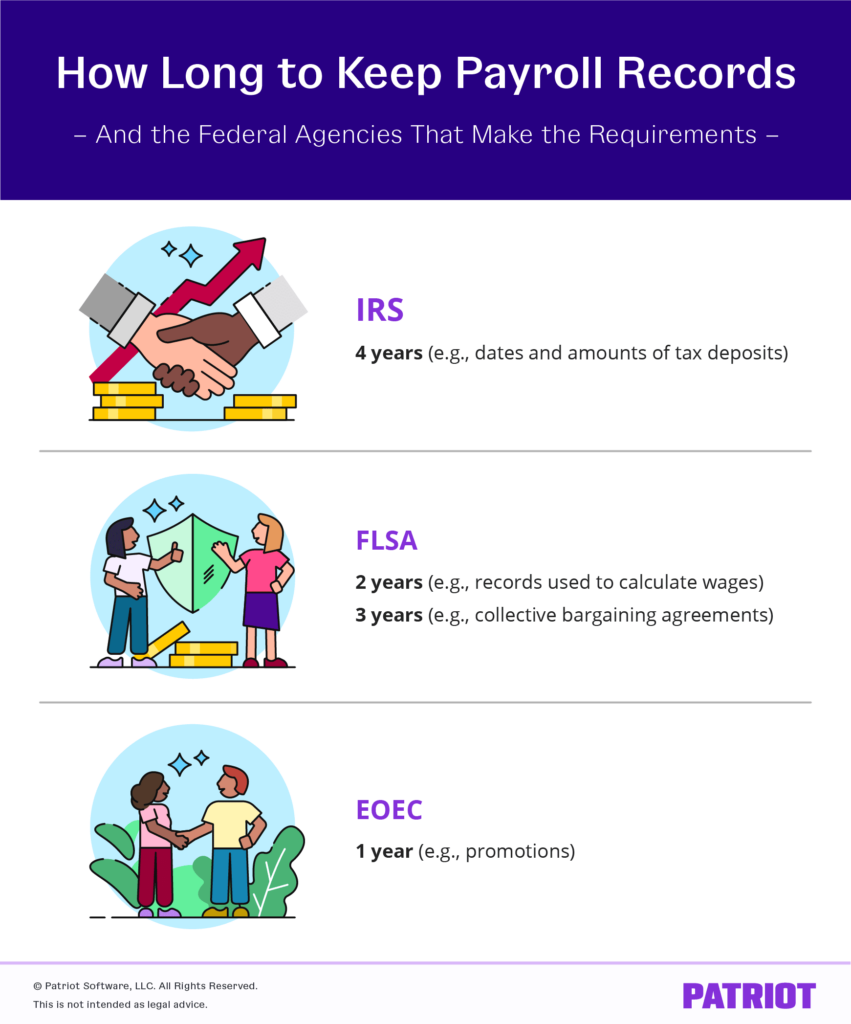

How Long To Keep Payroll Records Finansdirekt24 se

Check more sample of How Long Must You Keep Records For Tax Purposes below

For How Long Must You Stay In Canada To Get Your Citizenship ImmiLaw

Pin On Maintaining A Home

How Long Should You Keep Financial Records

Paperwork In France How Long Should You Keep Records FrenchEntr e

How To Keep Records For High School Homeschoolers School Homeschool

How Long Should You Keep Business Tax Records And Receipts Basis 365

https://assets.publishing.service.gov.uk › ...

How long must you keep your records Self employed or in partnership You have to keep your records for at least five years from 31 January following the tax year that the tax return relates

https://www.irs.gov › businesses › small-businesses...

The business you are in affects the type of records you need to keep for federal tax purposes Your recordkeeping system should include a summary of your business

How long must you keep your records Self employed or in partnership You have to keep your records for at least five years from 31 January following the tax year that the tax return relates

The business you are in affects the type of records you need to keep for federal tax purposes Your recordkeeping system should include a summary of your business

Paperwork In France How Long Should You Keep Records FrenchEntr e

Pin On Maintaining A Home

How To Keep Records For High School Homeschoolers School Homeschool

How Long Should You Keep Business Tax Records And Receipts Basis 365

Jay Jay Says 2014

Professor Tax USA Bookkeeping And Tax Services How Long Should I

Professor Tax USA Bookkeeping And Tax Services How Long Should I

How To Fill Out An IR330C Form A Step by Step Guide Afirmo NZ