In the digital age, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. For educational purposes for creative projects, simply to add the personal touch to your area, How Long Must I Keep Records For Irs have become an invaluable source. In this article, we'll dive into the world of "How Long Must I Keep Records For Irs," exploring the different types of printables, where they are, and how they can enhance various aspects of your life.

Get Latest How Long Must I Keep Records For Irs Below

How Long Must I Keep Records For Irs

How Long Must I Keep Records For Irs -

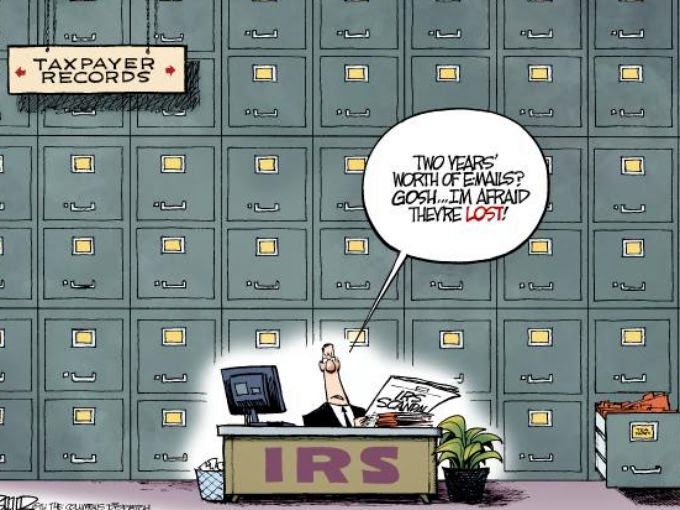

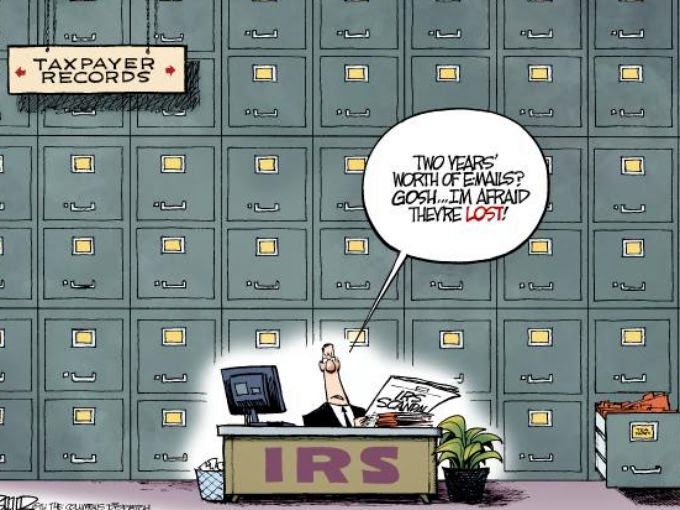

Verkko 21 syysk 2023 nbsp 0183 32 The records should substantiate both your income and expenses If you have employees you must keep all your employment tax records for at least 4 years after the tax becomes due or is paid whichever is later Additional Resources Recordkeeping Publication 15 Circular E Employer s Tax Guide Publication 583

Verkko 2 toukok 2023 nbsp 0183 32 How long should I keep records The length of time you should keep a document depends on the action expense or event the document records You must keep your records as long as needed to prove the income or deductions on a tax return

Printables for free cover a broad collection of printable resources available online for download at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and much more. The value of How Long Must I Keep Records For Irs is their flexibility and accessibility.

More of How Long Must I Keep Records For Irs

How Long Should You Keep Your Records MCA Blog

How Long Should You Keep Your Records MCA Blog

Verkko 25 helmik 2022 nbsp 0183 32 To be on the safe side McBride says to keep all tax records for at least seven years Keep forever

Verkko You are required by the IRS Internal Revenue Service to keep your tax records for 6 years if you underreported your income which accounts for more than 25 of your gross income If you have a cut and dry tax return with direct W2 income this additional time requirement does not apply to you

How Long Must I Keep Records For Irs have risen to immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Modifications: They can make print-ready templates to your specific requirements when it comes to designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational value: Printables for education that are free can be used by students from all ages, making them a valuable aid for parents as well as educators.

-

It's easy: Fast access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more How Long Must I Keep Records For Irs

Questions From Designated School Officials How Long Must I Keep

Questions From Designated School Officials How Long Must I Keep

Verkko 9 toukok 2021 nbsp 0183 32 Keep records for six years if you do not report income that you should report and it is more than 25 of the gross income shown on your return Keep records indefinitely if you do not file a return

Verkko 28 lokak 2022 nbsp 0183 32 Keep tax records for six years if You could have underreported your income by 25 If this is the case the IRS can review your taxes from up to six years ago

Now that we've piqued your curiosity about How Long Must I Keep Records For Irs we'll explore the places the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of How Long Must I Keep Records For Irs for various needs.

- Explore categories such as decorating your home, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching tools.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- The blogs are a vast range of interests, all the way from DIY projects to party planning.

Maximizing How Long Must I Keep Records For Irs

Here are some innovative ways to make the most of How Long Must I Keep Records For Irs:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets for free for teaching at-home and in class.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

How Long Must I Keep Records For Irs are a treasure trove of fun and practical tools that can meet the needs of a variety of people and interest. Their accessibility and flexibility make them an essential part of the professional and personal lives of both. Explore the vast array of How Long Must I Keep Records For Irs today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes, they are! You can print and download these tools for free.

-

Can I use the free printing templates for commercial purposes?

- It's determined by the specific rules of usage. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables could have limitations regarding usage. Make sure to read the terms and condition of use as provided by the creator.

-

How can I print How Long Must I Keep Records For Irs?

- You can print them at home using printing equipment or visit an in-store print shop to get the highest quality prints.

-

What program do I need to run printables that are free?

- Most PDF-based printables are available as PDF files, which can be opened with free software such as Adobe Reader.

How Long Must I Wait David Grim Flickr

What Homeschooling Records Must I Keep Homeschool Records Answers

Check more sample of How Long Must I Keep Records For Irs below

Mike Grant How Long Must I Continue 2003 Vinyl Discogs

Jay Jay Says 2014

How Long Must I Wait For You to Become What I Need Street Style

PDF The Importance Of Record Keeping Why Keep Records Idd Omy

How Long Must We Wait Before We Know I Was Safe I C Flickr

Are You Holding On To Your Tax Records Here s How Long You Should Keep

https://www.irs.gov/businesses/small-businesses-self-employed/...

Verkko 2 toukok 2023 nbsp 0183 32 How long should I keep records The length of time you should keep a document depends on the action expense or event the document records You must keep your records as long as needed to prove the income or deductions on a tax return

https://www.businessinsider.com/personal-finance/how-long-to-keep-tax...

Verkko Hold on to your records for a bare minimum of 3 years quot The general rule of thumb is to keep your tax returns for at least three years from the date you filed it the due date or the date you

Verkko 2 toukok 2023 nbsp 0183 32 How long should I keep records The length of time you should keep a document depends on the action expense or event the document records You must keep your records as long as needed to prove the income or deductions on a tax return

Verkko Hold on to your records for a bare minimum of 3 years quot The general rule of thumb is to keep your tax returns for at least three years from the date you filed it the due date or the date you

PDF The Importance Of Record Keeping Why Keep Records Idd Omy

Jay Jay Says 2014

How Long Must We Wait Before We Know I Was Safe I C Flickr

Are You Holding On To Your Tax Records Here s How Long You Should Keep

In The Studio Smart And Thorough Record Keeping

How Long To Keep Records For IRS

How Long To Keep Records For IRS

IRS What Tax Records To Keep St George News