In this day and age where screens have become the dominant feature of our lives and the appeal of physical printed objects hasn't waned. Whatever the reason, whether for education project ideas, artistic or simply to add an extra personal touch to your space, How Long Do You Need To Keep Records For Tax Purposes are a great source. This article will take a dive into the sphere of "How Long Do You Need To Keep Records For Tax Purposes," exploring what they are, where they can be found, and the ways that they can benefit different aspects of your life.

Get Latest How Long Do You Need To Keep Records For Tax Purposes Below

How Long Do You Need To Keep Records For Tax Purposes

How Long Do You Need To Keep Records For Tax Purposes -

Keep records for three years from the date you filed your original return or two years from the date you paid the tax whichever is later if you file a claim for credit or refund after

You have to keep your records for at least five years from 31 January following the tax year that the tax return relates to For example if you file your 2011 12 tax return by 31

How Long Do You Need To Keep Records For Tax Purposes encompass a wide array of printable materials that are accessible online for free cost. These resources come in various types, like worksheets, templates, coloring pages, and many more. The appealingness of How Long Do You Need To Keep Records For Tax Purposes lies in their versatility and accessibility.

More of How Long Do You Need To Keep Records For Tax Purposes

How Long To Keep Records Personal And Business MK Library

How Long To Keep Records Personal And Business MK Library

For additional information refer to Recordkeeping for Employers and Publication 15 Circular E Employers Tax Guide Page Last Reviewed or Updated 22 Mar 2024 Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes

How long should you keep your tax returns Once you file your taxes you should plan to keep your tax returns for a minimum of three years from the date you filed your original return

How Long Do You Need To Keep Records For Tax Purposes have risen to immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Customization: You can tailor printing templates to your own specific requirements such as designing invitations, organizing your schedule, or even decorating your house.

-

Educational Value These How Long Do You Need To Keep Records For Tax Purposes offer a wide range of educational content for learners of all ages. This makes them a useful tool for parents and educators.

-

Easy to use: Access to a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more How Long Do You Need To Keep Records For Tax Purposes

How Long Do You Keep Your Tax Records Zasio Enterprises

How Long Do You Keep Your Tax Records Zasio Enterprises

To be on the safe side McBride says to keep all tax records for at least seven years Keep forever

That means you should keep your tax records for three years from the date you filed the original return This is good practice too because you generally have three years from when

We hope we've stimulated your interest in How Long Do You Need To Keep Records For Tax Purposes and other printables, let's discover where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection in How Long Do You Need To Keep Records For Tax Purposes for different motives.

- Explore categories like home decor, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets as well as flashcards and other learning materials.

- It is ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- These blogs cover a broad range of topics, that range from DIY projects to party planning.

Maximizing How Long Do You Need To Keep Records For Tax Purposes

Here are some unique ways for you to get the best of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print out free worksheets and activities for teaching at-home also in the classes.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

How Long Do You Need To Keep Records For Tax Purposes are a treasure trove of creative and practical resources for a variety of needs and passions. Their accessibility and versatility make them a fantastic addition to both personal and professional life. Explore the vast world of How Long Do You Need To Keep Records For Tax Purposes now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes, they are! You can print and download these documents for free.

-

Do I have the right to use free printables for commercial uses?

- It is contingent on the specific usage guidelines. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright rights issues with How Long Do You Need To Keep Records For Tax Purposes?

- Some printables may have restrictions in use. You should read the terms and condition of use as provided by the creator.

-

How can I print How Long Do You Need To Keep Records For Tax Purposes?

- Print them at home using your printer or visit an in-store print shop to get top quality prints.

-

What program do I require to open printables for free?

- Most PDF-based printables are available in PDF format. These can be opened using free programs like Adobe Reader.

What Business Records You Should Keep For Tax Purposes Mazuma

What Business Records You Should Keep For Tax Purposes Mazuma

Check more sample of How Long Do You Need To Keep Records For Tax Purposes below

How Long Do You Need To Keep Your Tax Records Miller Place NY Patch

How Long Do You Need To Keep Records

How Long To Keep Records For Business Taxes Rocket Lawyer Key

How Long Should You Keep Your Records And Tax Return The Wealthy

How Long To Keep Tax Records Plus How To Organize Old Tax Returns In

How Long Do You Need To Keep Personal Financial Records UK AI

https://assets.publishing.service.gov.uk/...

You have to keep your records for at least five years from 31 January following the tax year that the tax return relates to For example if you file your 2011 12 tax return by 31

https://www.irs.gov/businesses/small-businesses...

How long should I keep records The length of time you should keep a document depends on the action expense or event the document records You must keep your records as long as needed to prove the income or deductions on a tax return

You have to keep your records for at least five years from 31 January following the tax year that the tax return relates to For example if you file your 2011 12 tax return by 31

How long should I keep records The length of time you should keep a document depends on the action expense or event the document records You must keep your records as long as needed to prove the income or deductions on a tax return

How Long Should You Keep Your Records And Tax Return The Wealthy

How Long Do You Need To Keep Records

How Long To Keep Tax Records Plus How To Organize Old Tax Returns In

How Long Do You Need To Keep Personal Financial Records UK AI

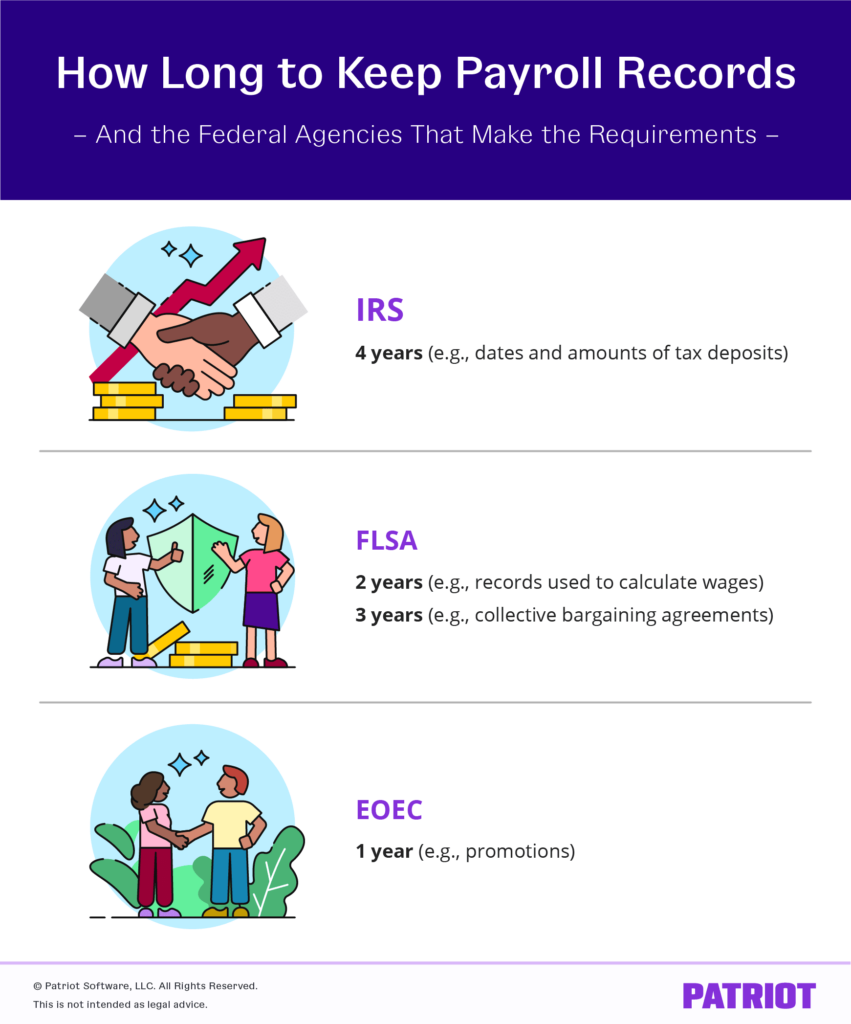

How Long To Keep Payroll Records Finansdirekt24 se

Tax Planning Includes Keeping Good Records LVBW

Tax Planning Includes Keeping Good Records LVBW

How Long Do You Need To Keep Records