In this age of electronic devices, where screens have become the dominant feature of our lives The appeal of tangible printed materials isn't diminishing. For educational purposes and creative work, or just adding some personal flair to your area, How Long Do You Have To Keep Records For Income Tax Purposes have become an invaluable resource. With this guide, you'll take a dive through the vast world of "How Long Do You Have To Keep Records For Income Tax Purposes," exploring their purpose, where they are, and ways they can help you improve many aspects of your daily life.

Get Latest How Long Do You Have To Keep Records For Income Tax Purposes Below

How Long Do You Have To Keep Records For Income Tax Purposes

How Long Do You Have To Keep Records For Income Tax Purposes -

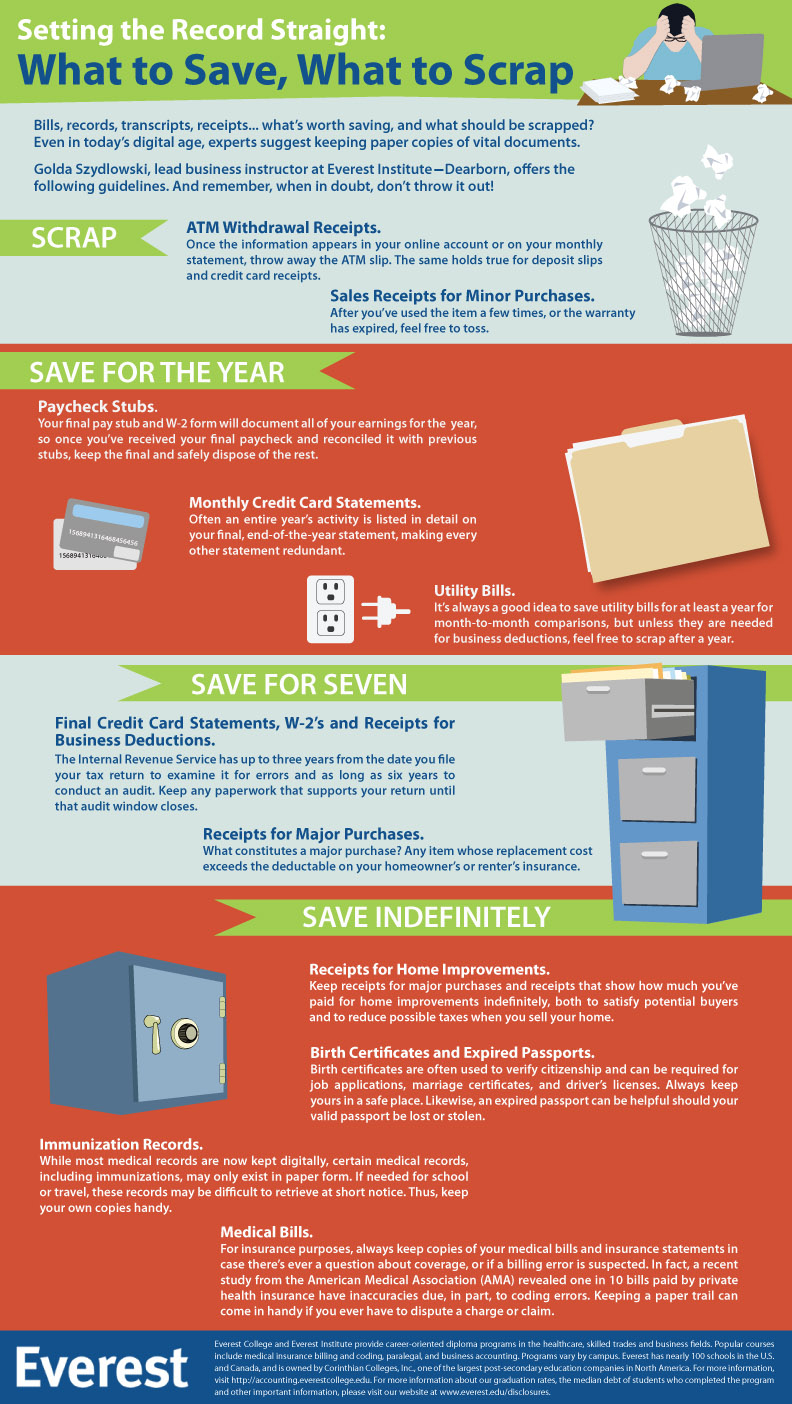

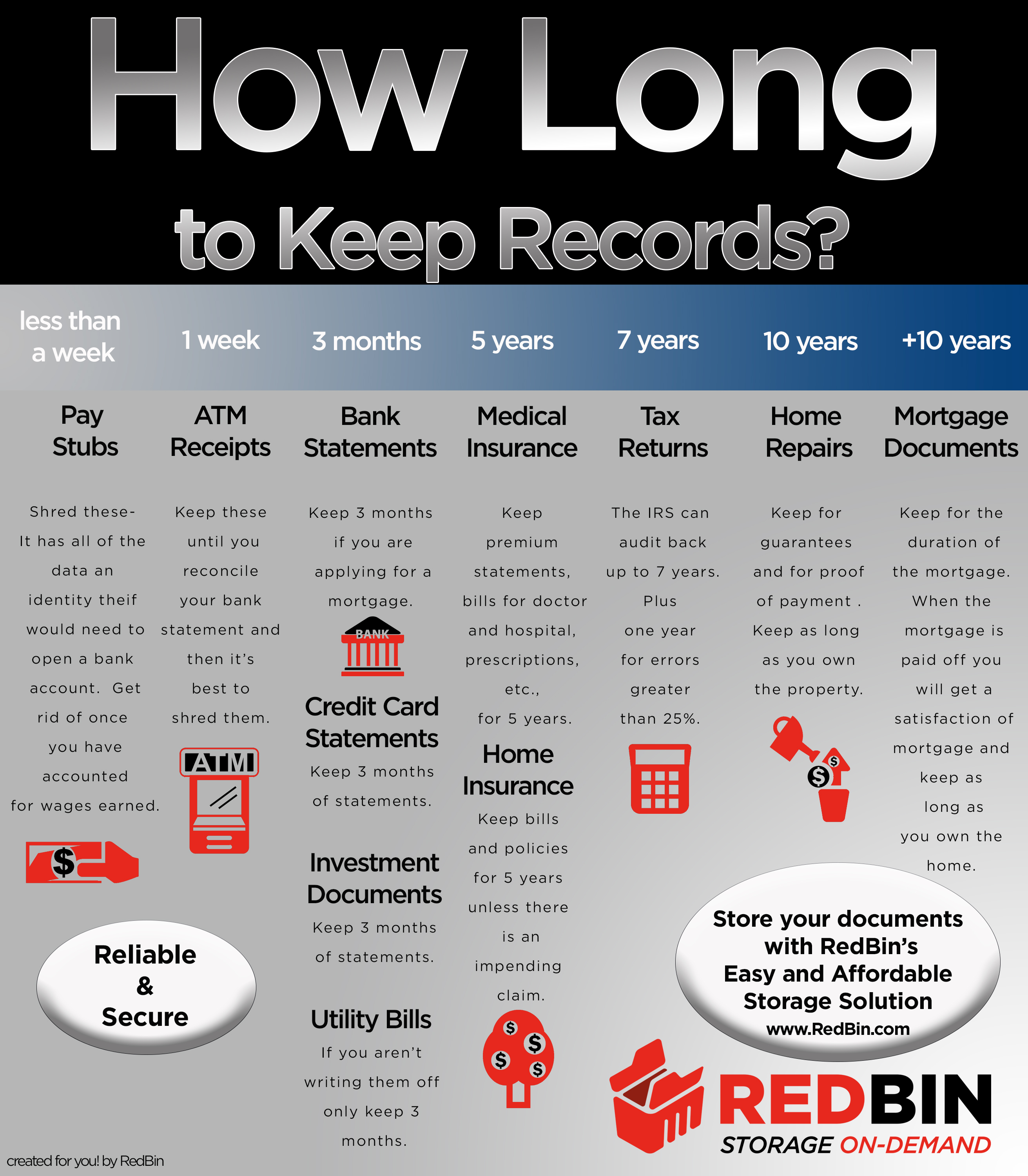

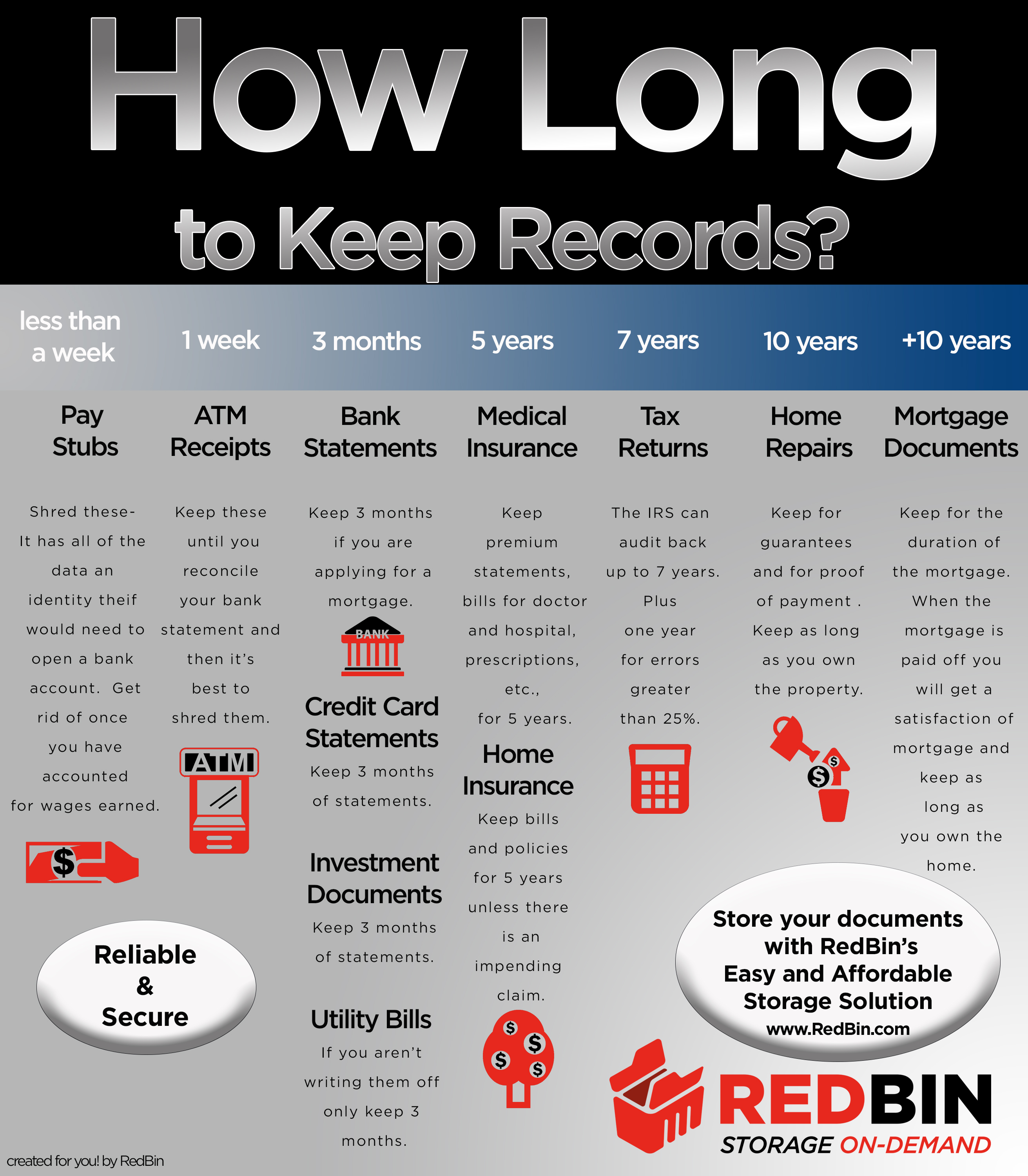

After filing your tax return organize and keep records for 3 6 7 or more years depending on statutes of limitations when the IRS may ask for them

How long should I keep records The length of time you should keep a document depends on the action expense or event the document records You must keep your records

How Long Do You Have To Keep Records For Income Tax Purposes cover a large variety of printable, downloadable materials that are accessible online for free cost. These resources come in various forms, like worksheets templates, coloring pages and many more. The beauty of How Long Do You Have To Keep Records For Income Tax Purposes lies in their versatility and accessibility.

More of How Long Do You Have To Keep Records For Income Tax Purposes

Tax Records What Should You Keep And For How Long

Tax Records What Should You Keep And For How Long

How long must you keep your records Self employed or in partnership You have to keep your records for at least five years from 31 January following the tax year that the tax return

Keep records for three years from the date you filed your original return or two years from the date you paid the tax whichever is later if you file a claim for credit or refund after you file your

The How Long Do You Have To Keep Records For Income Tax Purposes have gained huge popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

customization: The Customization feature lets you tailor designs to suit your personal needs, whether it's designing invitations making your schedule, or decorating your home.

-

Educational value: Downloads of educational content for free cater to learners of all ages, making them a vital resource for educators and parents.

-

Accessibility: Instant access to many designs and templates, which saves time as well as effort.

Where to Find more How Long Do You Have To Keep Records For Income Tax Purposes

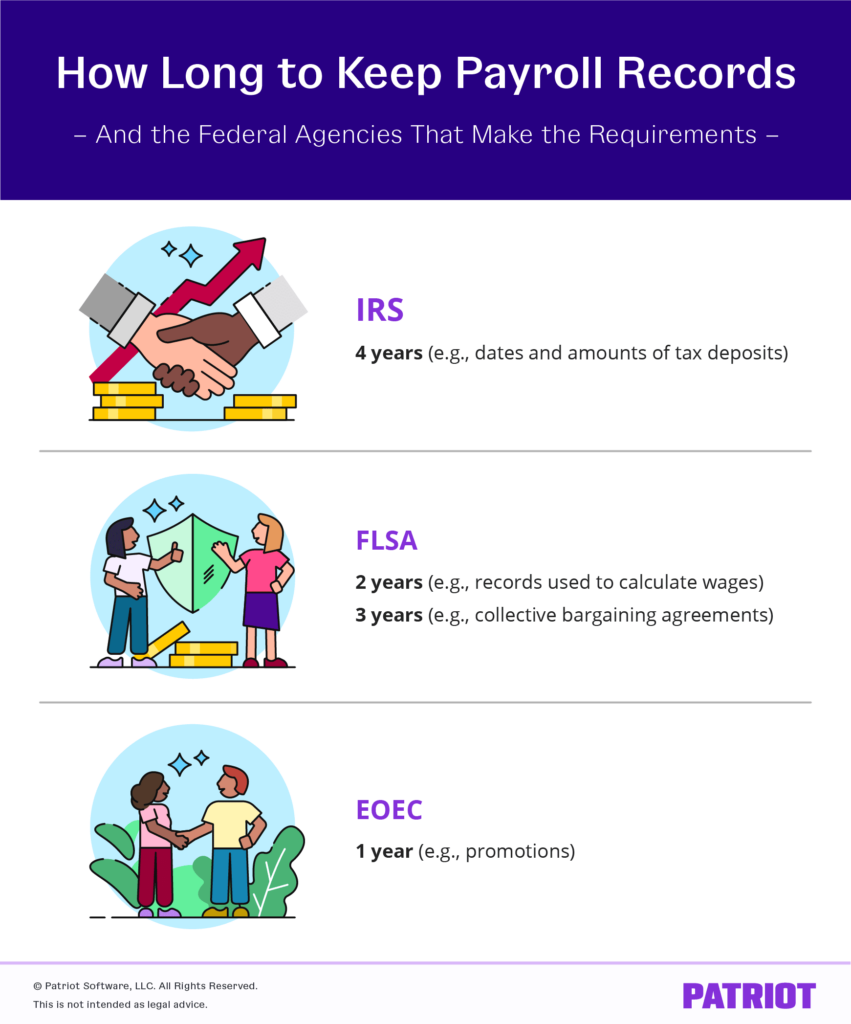

How Long To Keep Payroll Records Finansdirekt24 se

How Long To Keep Payroll Records Finansdirekt24 se

Advice on what records you need to keep for tax purposes and how long you need to keep them

The IRS recommends keeping returns and other tax documents for three years or two years from when you paid the tax whichever is later The IRS has a statute of limitations on conducting

After we've peaked your interest in printables for free Let's see where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection in How Long Do You Have To Keep Records For Income Tax Purposes for different applications.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- These blogs cover a broad range of topics, that includes DIY projects to party planning.

Maximizing How Long Do You Have To Keep Records For Income Tax Purposes

Here are some inventive ways for you to get the best of How Long Do You Have To Keep Records For Income Tax Purposes:

1. Home Decor

- Print and frame beautiful artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to reinforce learning at home also in the classes.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

How Long Do You Have To Keep Records For Income Tax Purposes are a treasure trove of fun and practical tools which cater to a wide range of needs and passions. Their accessibility and versatility make them an essential part of both professional and personal life. Explore the plethora of How Long Do You Have To Keep Records For Income Tax Purposes and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes you can! You can print and download these items for free.

-

Can I use the free printables to make commercial products?

- It's contingent upon the specific terms of use. Always consult the author's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables might have limitations regarding their use. Check the conditions and terms of use provided by the creator.

-

How can I print printables for free?

- Print them at home using an printer, or go to an in-store print shop to get superior prints.

-

What program do I require to view How Long Do You Have To Keep Records For Income Tax Purposes?

- Most printables come in the format of PDF, which is open with no cost software, such as Adobe Reader.

How Long To Keep Tax Records And Other Statements BrandonGaille

How Long Do I Have To Keep My Business Tax Records Hogg Shain Scheck

Check more sample of How Long Do You Have To Keep Records For Income Tax Purposes below

How Long Do You Need To Keep Your Tax Records For Our Expert Advice

How Long To Keep Records For Business Taxes Rocket Lawyer Key

What Business Records You Should Keep For Tax Purposes Mazuma

RedBin Blog Need More Storage

How Long Do You Have To Keep Payroll Records BambooHR Blog

How Long To Keep Tax Records Plus How To Organize Old Tax Returns In

https://www.irs.gov/businesses/small-businesses...

How long should I keep records The length of time you should keep a document depends on the action expense or event the document records You must keep your records

https://www.irs.gov/taxtopics/tc305

The records should substantiate both your income and expenses If you have employees you must keep all your employment tax records for at least 4 years after the tax

How long should I keep records The length of time you should keep a document depends on the action expense or event the document records You must keep your records

The records should substantiate both your income and expenses If you have employees you must keep all your employment tax records for at least 4 years after the tax

RedBin Blog Need More Storage

How Long To Keep Records For Business Taxes Rocket Lawyer Key

How Long Do You Have To Keep Payroll Records BambooHR Blog

How Long To Keep Tax Records Plus How To Organize Old Tax Returns In

How Long To Keep Business Records For Irs Audit Business Walls

How Long Do You Have To Keep Accounting Records Paperwingrvice web

How Long Do You Have To Keep Accounting Records Paperwingrvice web

How Long To Keep Tax Records And Other Statements BrandonGaille