In this age of technology, with screens dominating our lives The appeal of tangible printed materials isn't diminishing. In the case of educational materials such as creative projects or simply to add an extra personal touch to your space, Donation Receipt Format Under Section 80g have become an invaluable source. With this guide, you'll take a dive in the world of "Donation Receipt Format Under Section 80g," exploring their purpose, where they can be found, and how they can improve various aspects of your daily life.

Get Latest Donation Receipt Format Under Section 80g Below

Donation Receipt Format Under Section 80g

Donation Receipt Format Under Section 80g -

Verkko 25 lokak 2021 nbsp 0183 32 80G Donation Format Posted on October 25 2021 by SRRF Greetings Is there any format issued by Income Tax or any government department for issuing

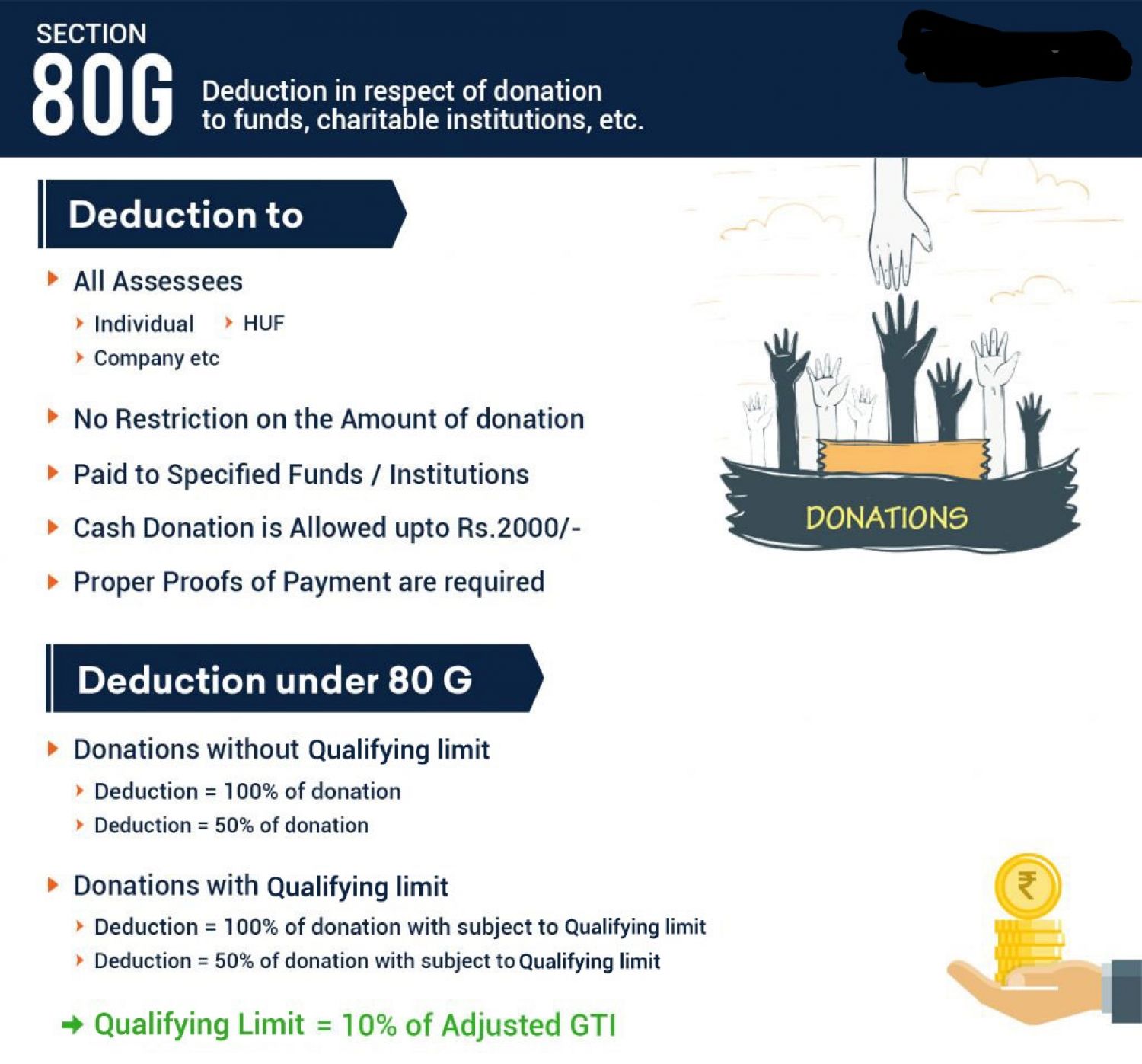

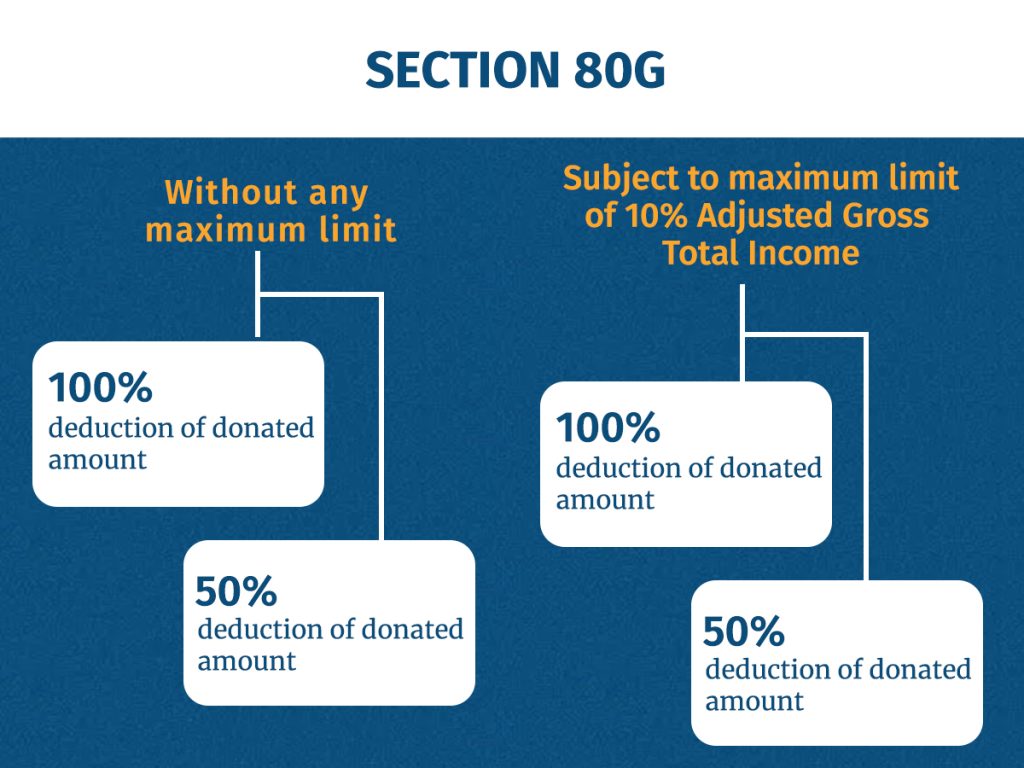

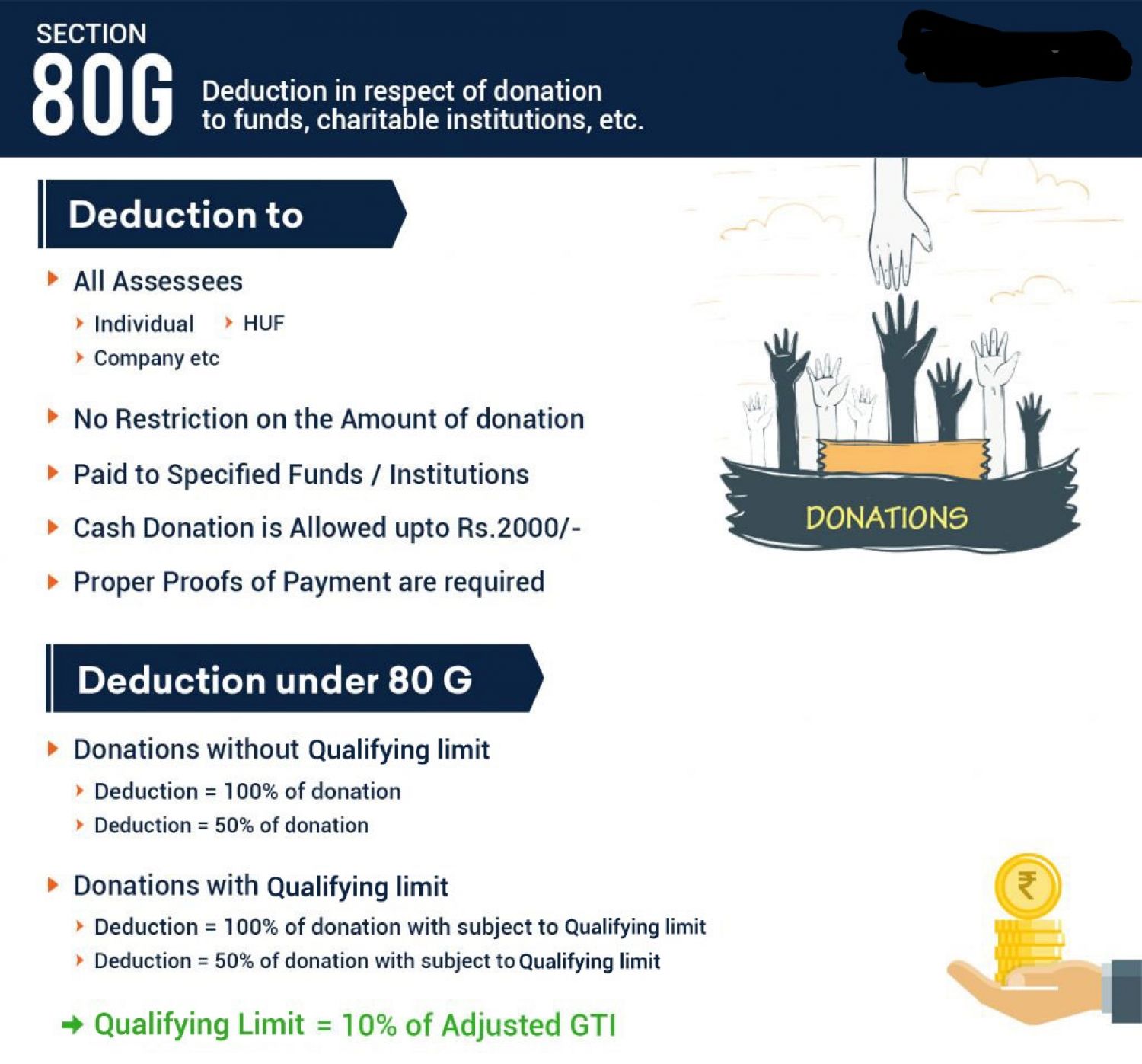

Verkko Tax Benefits of Donation Under Section 80g Section 80G of the Income Tax Act permits deductions for donations made to specific relief funds and charitable organisations Any taxpayer may claim this

The Donation Receipt Format Under Section 80g are a huge collection of printable materials available online at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages, and more. The great thing about Donation Receipt Format Under Section 80g lies in their versatility and accessibility.

More of Donation Receipt Format Under Section 80g

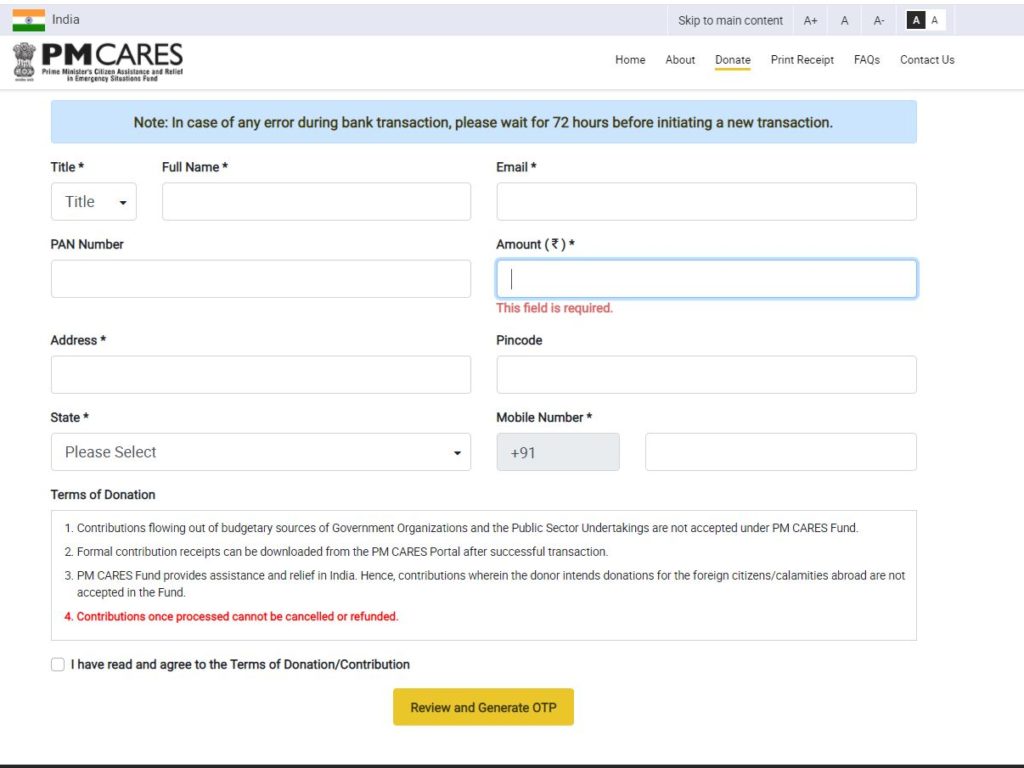

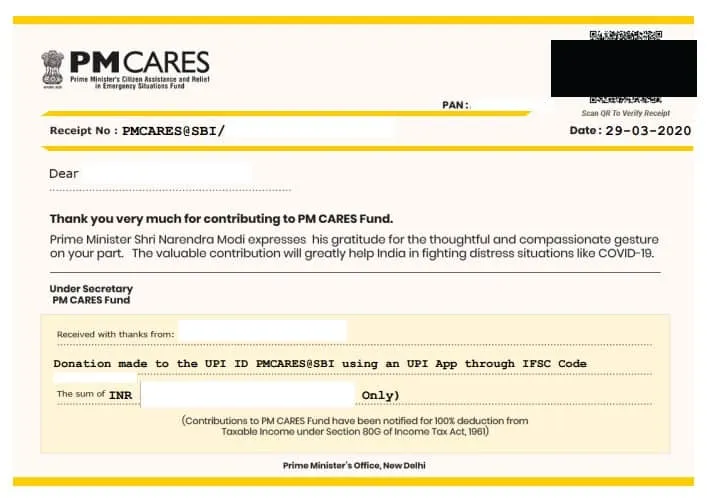

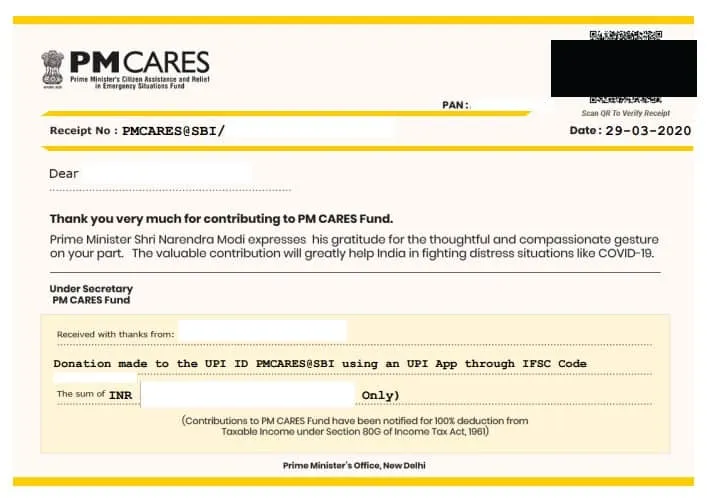

Pm Cares Fund Address Details For 80g GST Guntur

Pm Cares Fund Address Details For 80g GST Guntur

Verkko 28 kes 228 k 2018 nbsp 0183 32 Stamped receipt For claiming deduction under Section 80G a receipt issued by the recipient trust is a must The receipt must contain the name address amp PAN of the Trust the

Verkko 13 kes 228 k 2023 nbsp 0183 32 It is crucial to note that cash donations exceeding 2 000 will not be eligible for the deduction under Section 80G How can you claim the deduction

The Donation Receipt Format Under Section 80g have gained huge popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Personalization Your HTML0 customization options allow you to customize the design to meet your needs whether you're designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Use: Educational printables that can be downloaded for free can be used by students of all ages. This makes these printables a powerful tool for teachers and parents.

-

Affordability: immediate access an array of designs and templates, which saves time as well as effort.

Where to Find more Donation Receipt Format Under Section 80g

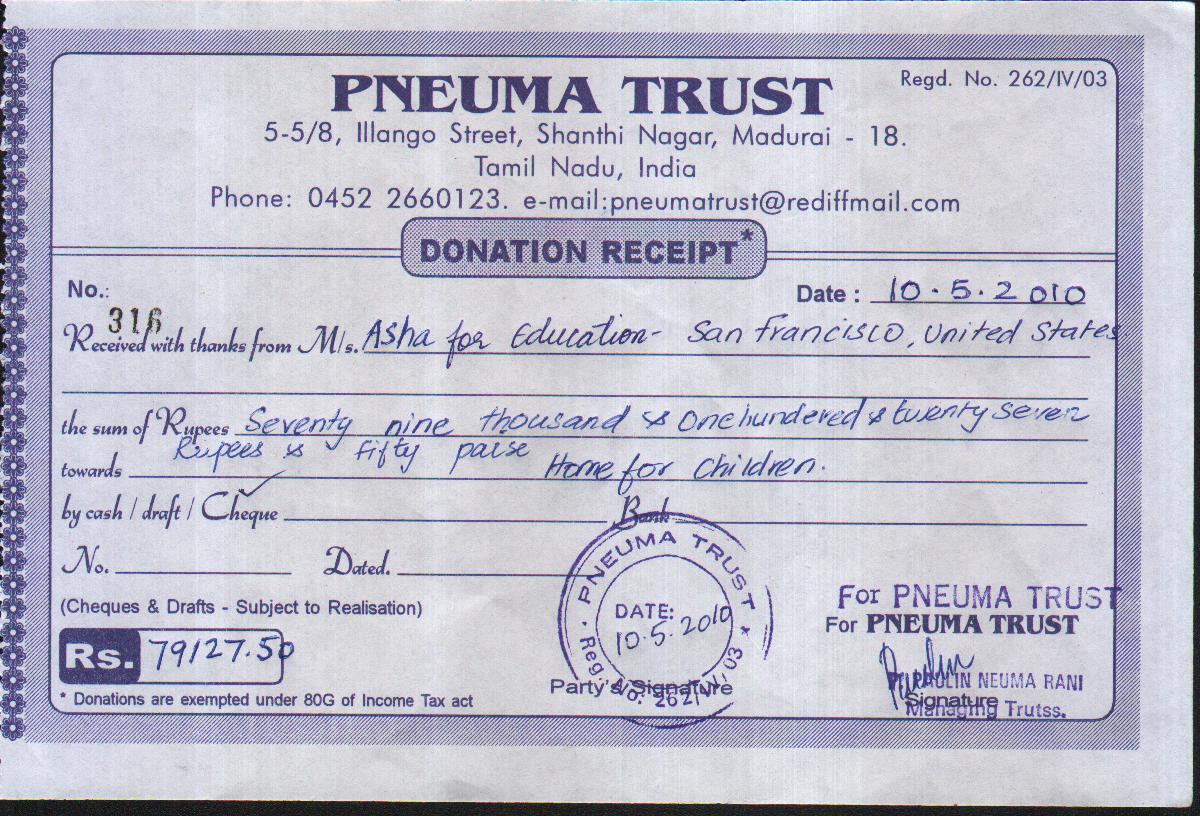

Project Details Asha For Education

Project Details Asha For Education

Verkko Donations made are eligible to be claimed as a deduction under Section 80G in all cases except in cases where the donation has been made in kind eg food clothes

Verkko 3 hein 228 k 2023 nbsp 0183 32 As per Section 80G donations are eligible for a 100 percent or 50 percent deduction with or without restriction How to claim the deduction To claim a deduction under Section 80G the taxpayer

We hope we've stimulated your interest in Donation Receipt Format Under Section 80g Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of purposes.

- Explore categories such as decorating your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs are a vast range of interests, that includes DIY projects to planning a party.

Maximizing Donation Receipt Format Under Section 80g

Here are some new ways of making the most of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Donation Receipt Format Under Section 80g are a treasure trove with useful and creative ideas for a variety of needs and desires. Their accessibility and versatility make them a valuable addition to both personal and professional life. Explore the endless world that is Donation Receipt Format Under Section 80g today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes, they are! You can print and download these free resources for no cost.

-

Are there any free templates for commercial use?

- It's based on the conditions of use. Always read the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may have restrictions on usage. You should read the conditions and terms of use provided by the designer.

-

How do I print Donation Receipt Format Under Section 80g?

- You can print them at home with an printer, or go to any local print store for superior prints.

-

What program do I need in order to open printables that are free?

- The majority are printed in the format of PDF, which can be opened using free software, such as Adobe Reader.

Online Step To Download 80G Receipt For Donation Made To PM Cares Fund

Learn Income Tax Benefits From Donations Under Section 80G

Check more sample of Donation Receipt Format Under Section 80g below

Donation Receipt Format For Charitable Trust India Free Download

Section 80g Of Income Tax Act Section 80g 5

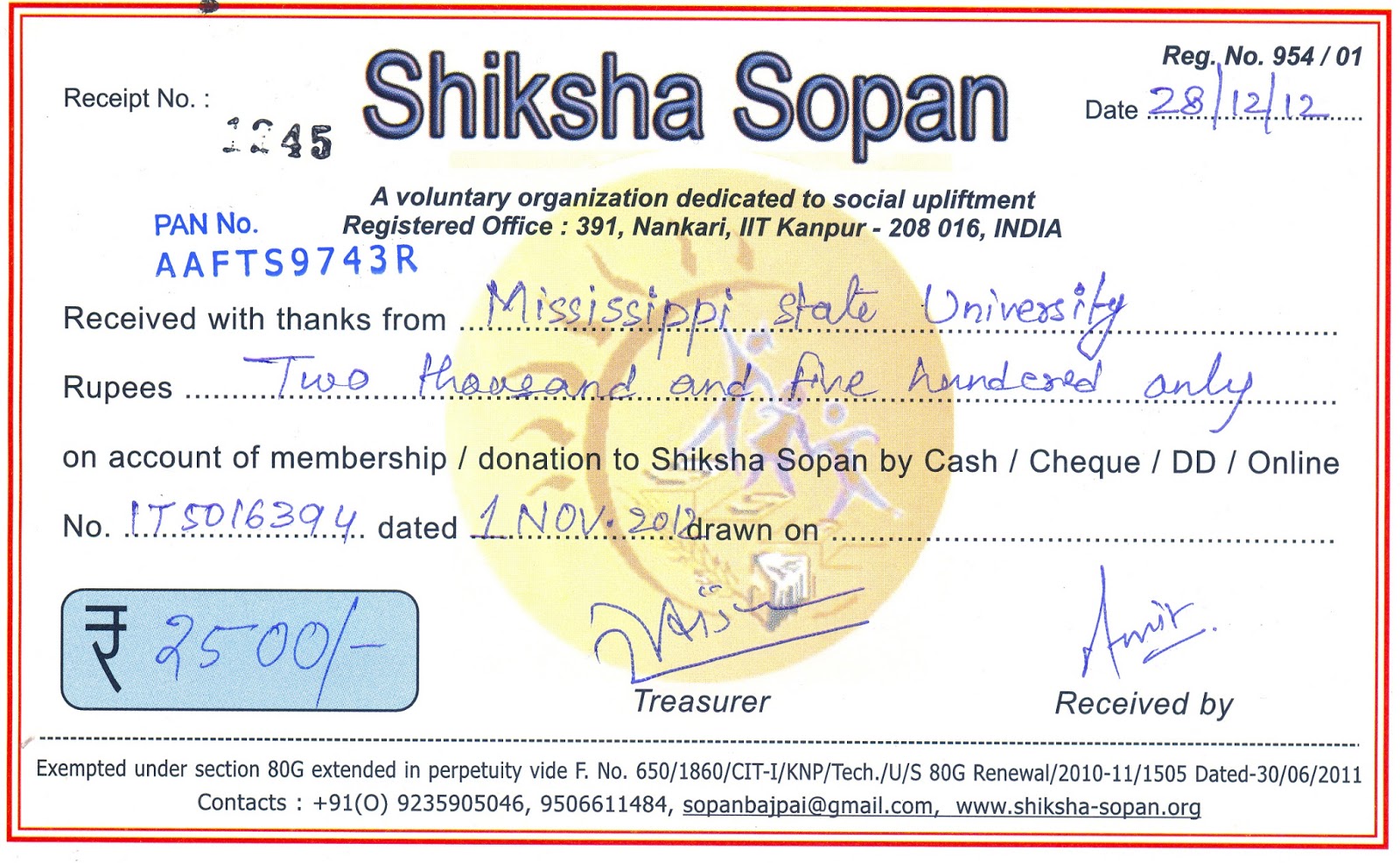

Contribution Receipt November 2012 Shiksha Sopan

The 80G Certificate And Tax Exemption For Nonprofits Vakilsearch Blog

Section 80G Of IT Act Tax Deduction On Donations To Charity

How To Download Receipts Of Donations Made To PM CARES Fund To Avail

https://vyaparapp.in/receipt-format/donation/…

Verkko Tax Benefits of Donation Under Section 80g Section 80G of the Income Tax Act permits deductions for donations made to specific relief funds and charitable organisations Any taxpayer may claim this

https://taxguru.in/income-tax/format-of-decleration-to-be-taken-from...

Verkko 10 lokak 2011 nbsp 0183 32 Kindly issue a stamped receipt and also exemption certificate under section 80G of the Income Tax Act 1961 for the above donation My PAN No is

Verkko Tax Benefits of Donation Under Section 80g Section 80G of the Income Tax Act permits deductions for donations made to specific relief funds and charitable organisations Any taxpayer may claim this

Verkko 10 lokak 2011 nbsp 0183 32 Kindly issue a stamped receipt and also exemption certificate under section 80G of the Income Tax Act 1961 for the above donation My PAN No is

The 80G Certificate And Tax Exemption For Nonprofits Vakilsearch Blog

Section 80g Of Income Tax Act Section 80g 5

Section 80G Of IT Act Tax Deduction On Donations To Charity

How To Download Receipts Of Donations Made To PM CARES Fund To Avail

Section 80G Deductions Make Donation To PM CARES Fund An Added Advantage

Information On Section 80G Of Income Tax Act Ebizfiling

Information On Section 80G Of Income Tax Act Ebizfiling

Changes In Norms Exemptions Under Section 80G Section 12A 12AA