In a world with screens dominating our lives and the appeal of physical printed material hasn't diminished. For educational purposes project ideas, artistic or simply to add the personal touch to your home, printables for free are a great source. For this piece, we'll dive into the world of "Debt Payoff Formula," exploring the benefits of them, where they can be found, and how they can add value to various aspects of your daily life.

Get Latest Debt Payoff Formula Below

Debt Payoff Formula

Debt Payoff Formula -

How our calculator works To use this calculator you ll need to gather the most recent statements for the debts you want to pay down and find the following

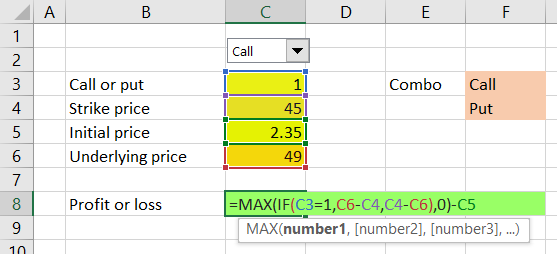

PMT 17 12 2 12 5400 the result is a monthly payment of 266 99 to pay the debt off in two years The rate argument is the interest rate per period for the loan For example in

Printables for free cover a broad assortment of printable materials available online at no cost. They are available in a variety of kinds, including worksheets templates, coloring pages and many more. The beauty of Debt Payoff Formula lies in their versatility and accessibility.

More of Debt Payoff Formula

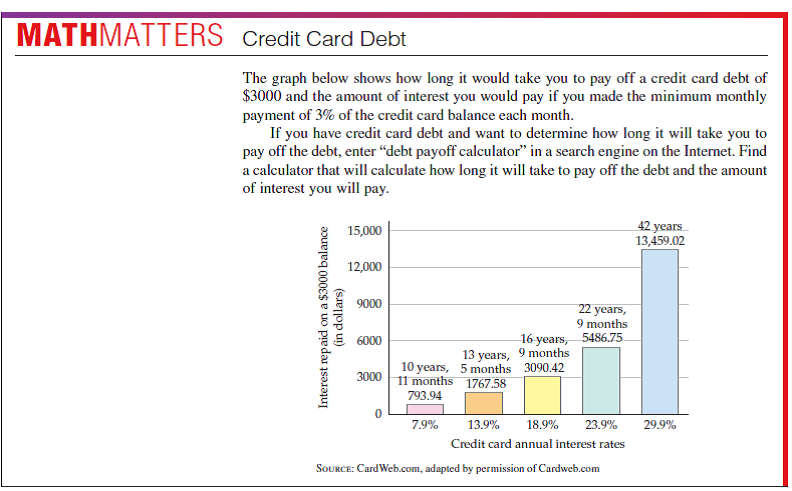

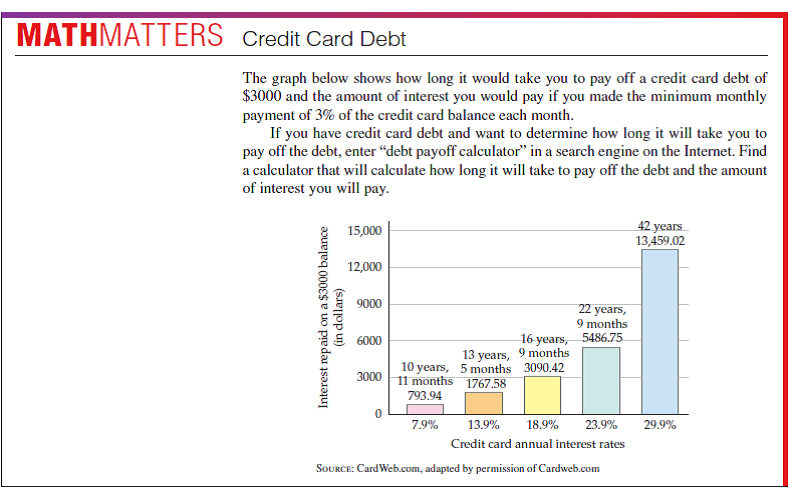

Credit Card Debt The APR Loan Payoff Formula Can Be Use Chegg

Credit Card Debt The APR Loan Payoff Formula Can Be Use Chegg

PV L 1 1 r n r Wherein PV is the present value of Outstanding Balance L is the existing Payment r is the rate of interest n is the frequency of

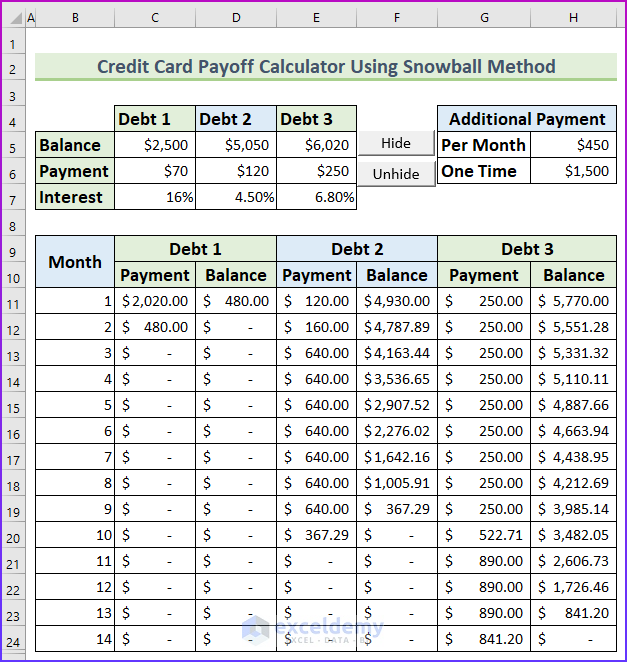

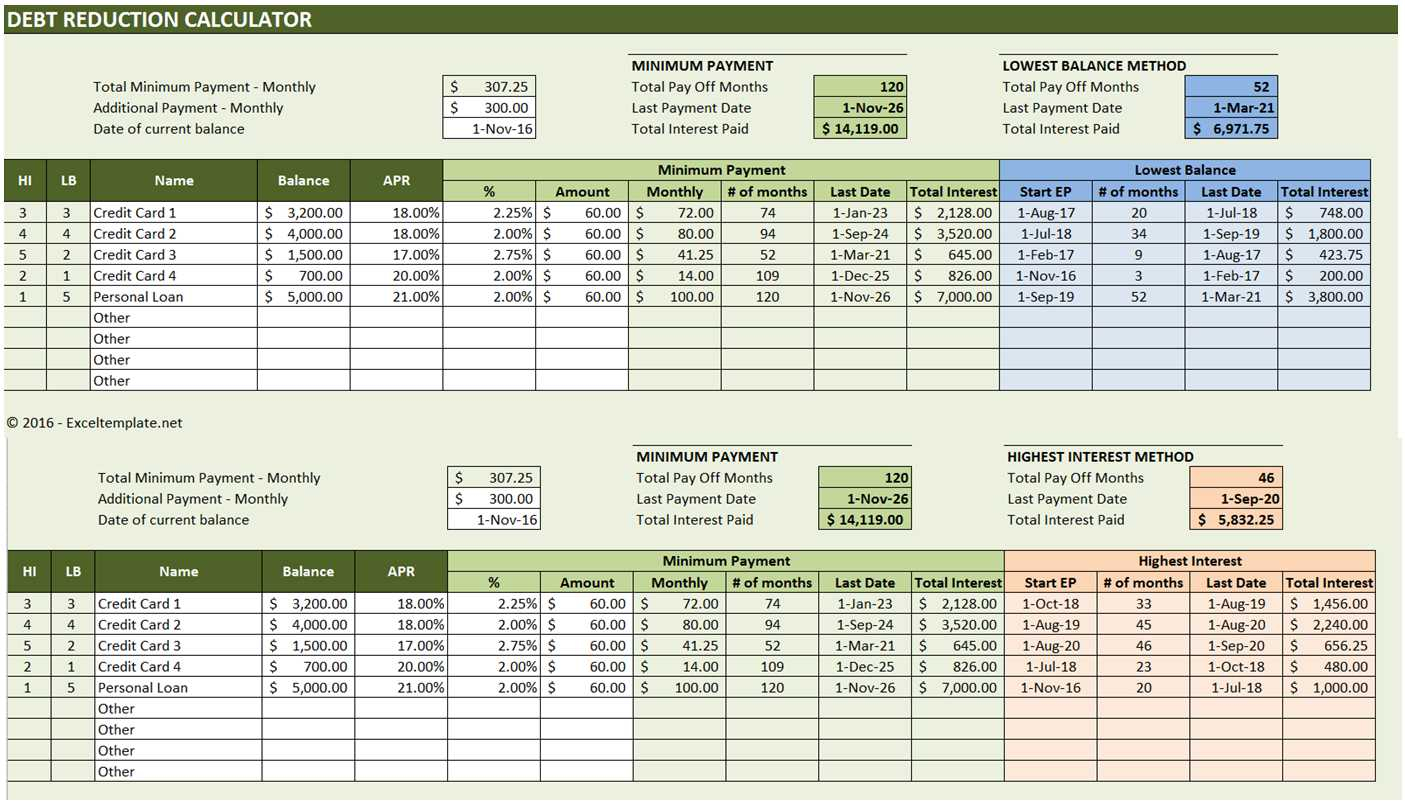

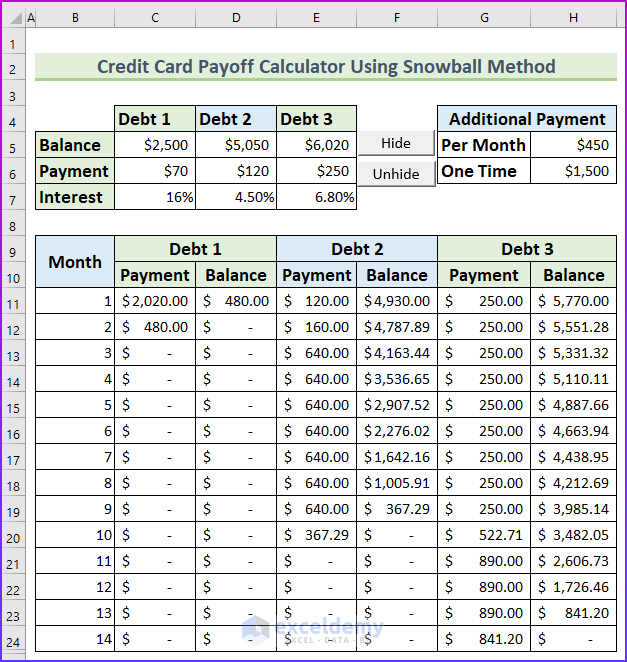

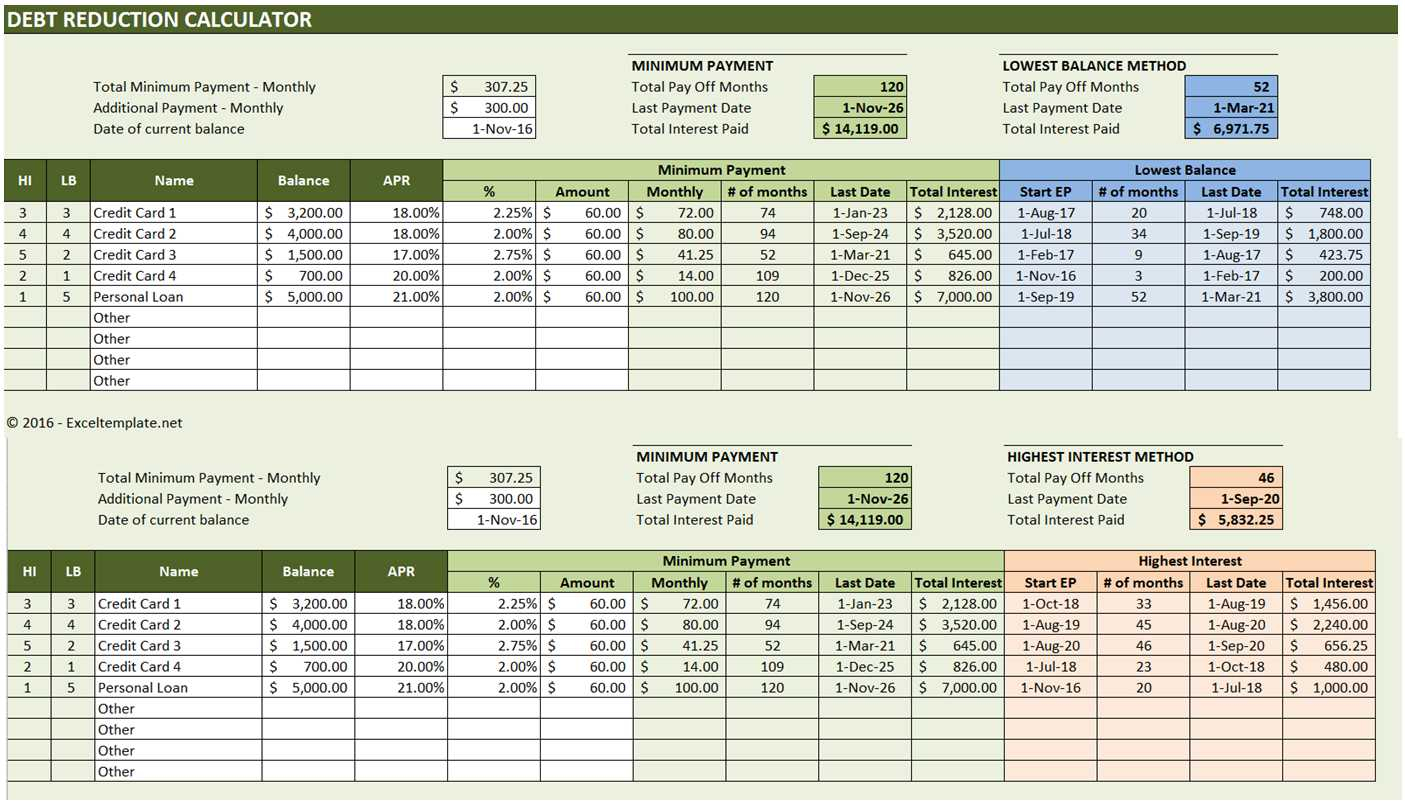

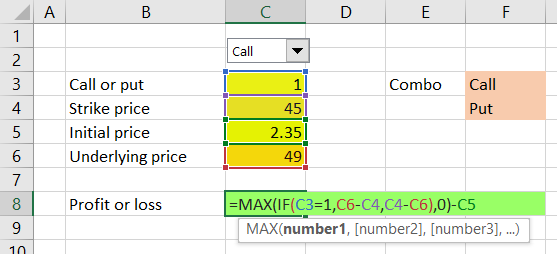

Creating a debt payoff calculator in Excel involves setting up a spreadsheet with input fields for debt amount interest rate and payment frequency Formulas can be used to

Debt Payoff Formula have risen to immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Customization: The Customization feature lets you tailor printed materials to meet your requirements in designing invitations planning your schedule or even decorating your home.

-

Educational Value Printing educational materials for no cost are designed to appeal to students of all ages, making them a valuable instrument for parents and teachers.

-

Accessibility: Access to a variety of designs and templates reduces time and effort.

Where to Find more Debt Payoff Formula

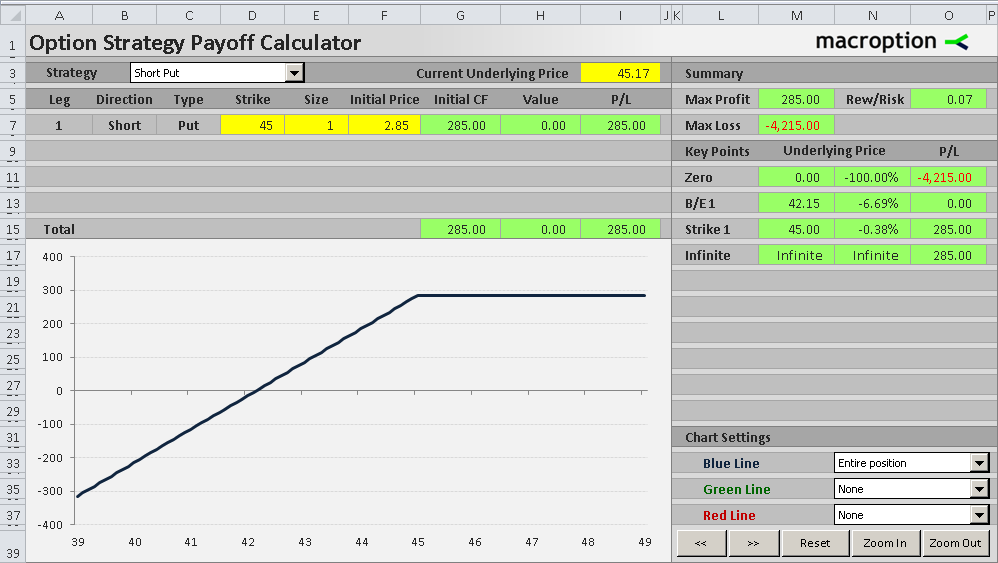

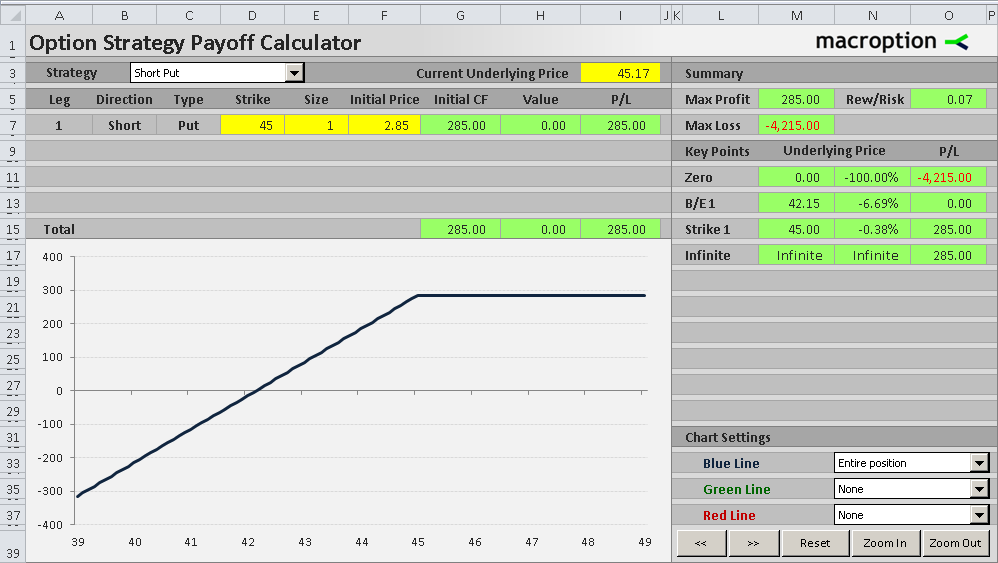

Put Option Meaning Buy Sell Example Definition Payoff Formula

Put Option Meaning Buy Sell Example Definition Payoff Formula

Our calculator can help you estimate when you ll pay off your credit card debt or other debt such as auto loans student loans or personal loans and how much you ll need to

Find out how long it will take you to pay off your credit card balance Use Forbes Advisor s credit card payoff calculator to meet your credit card payment goals

If we've already piqued your curiosity about Debt Payoff Formula, let's explore where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Debt Payoff Formula to suit a variety of reasons.

- Explore categories such as decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free or flashcards as well as learning tools.

- Ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a wide array of topics, ranging starting from DIY projects to planning a party.

Maximizing Debt Payoff Formula

Here are some ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Debt Payoff Formula are an abundance of innovative and useful resources for a variety of needs and preferences. Their access and versatility makes them an essential part of any professional or personal life. Explore the endless world of Debt Payoff Formula today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes, they are! You can download and print these documents for free.

-

Can I download free printables in commercial projects?

- It's dependent on the particular terms of use. Always read the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables may be subject to restrictions regarding usage. Be sure to read the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- You can print them at home using printing equipment or visit a local print shop to purchase high-quality prints.

-

What program do I need to open printables at no cost?

- The majority of printed documents are in PDF format. These is open with no cost programs like Adobe Reader.

Credit Card Payoff Schedule FarasFeleena

Credit Card Debt Payoff Tracker

![]()

Check more sample of Debt Payoff Formula below

Accelerated Debt Payoff Spreadsheet Excel Templates

Credit Card Payoff Calculator Excel Templates

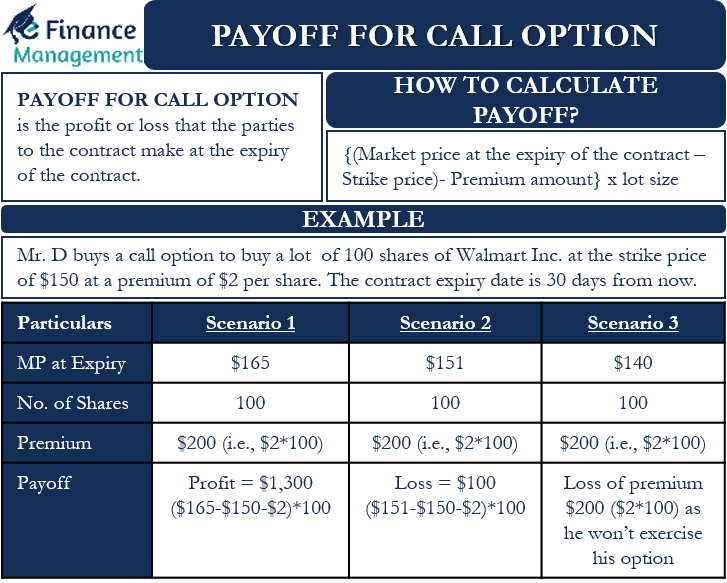

Call Option Profit Formula AmaynaSulav

Debt Repayment Spreadsheet Db excel

Using Financial Derivatives To Structure Grade Payoff Formula

Merging Call And Put Payoff Calculations Macroption

https://support.microsoft.com/en-us/office/using...

PMT 17 12 2 12 5400 the result is a monthly payment of 266 99 to pay the debt off in two years The rate argument is the interest rate per period for the loan For example in

https://www.ramseysolutions.com/debt/…

With every debt you pay off you gain speed until you re an unstoppable debt crushing force Here s how the debt snowball works Step 1 List your debts from smallest to largest regardless of interest rate Step 2 Make

PMT 17 12 2 12 5400 the result is a monthly payment of 266 99 to pay the debt off in two years The rate argument is the interest rate per period for the loan For example in

With every debt you pay off you gain speed until you re an unstoppable debt crushing force Here s how the debt snowball works Step 1 List your debts from smallest to largest regardless of interest rate Step 2 Make

Debt Repayment Spreadsheet Db excel

Credit Card Payoff Calculator Excel Templates

Using Financial Derivatives To Structure Grade Payoff Formula

Merging Call And Put Payoff Calculations Macroption

Early Mortgage Payoff Calculator Be Debt Free MLS Mortgage

Short Put Payoff Diagram And Formula Macroption

Short Put Payoff Diagram And Formula Macroption

Preview NARS Powermatte Long Lasting Lipstick BeautyVelle Makeup News