In the digital age, where screens dominate our lives yet the appeal of tangible printed products hasn't decreased. For educational purposes, creative projects, or simply adding the personal touch to your space, 80g Donation Details are now a vital source. Through this post, we'll dive into the sphere of "80g Donation Details," exploring the different types of printables, where to find them and how they can be used to enhance different aspects of your life.

Get Latest 80g Donation Details Below

80g Donation Details

80g Donation Details -

As per 80G you can deduct your donations to Central and State Relief Funds NGOs and other charitable institutions to arrive at your taxable income In this article we will tell you

Donations to the following are eligible for 50 deduction under section 80G subject to 10 of adjusted gross total income 1 Donation to the Government or any local authority to be utilized by them for any charitable

The 80g Donation Details are a huge collection of printable resources available online for download at no cost. They are available in numerous types, like worksheets, templates, coloring pages, and many more. One of the advantages of 80g Donation Details is in their variety and accessibility.

More of 80g Donation Details

Charity Donation Flyer Free PSD PsdDaddy

Charity Donation Flyer Free PSD PsdDaddy

Summary Section 80G of the Income Tax Act offers tax benefits for donations made to specific funds charitable institutions or trusts Taxpayers eligible to claim these

Discover how to deduct donations to particular charity or organisations Deduct the amount from your taxed income under Part 80G of the Income Tax Act

80g Donation Details have risen to immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

The ability to customize: We can customize the design to meet your needs be it designing invitations to organize your schedule or even decorating your house.

-

Educational Value Printing educational materials for no cost cater to learners of all ages. This makes them a useful instrument for parents and teachers.

-

Accessibility: instant access a myriad of designs as well as templates saves time and effort.

Where to Find more 80g Donation Details

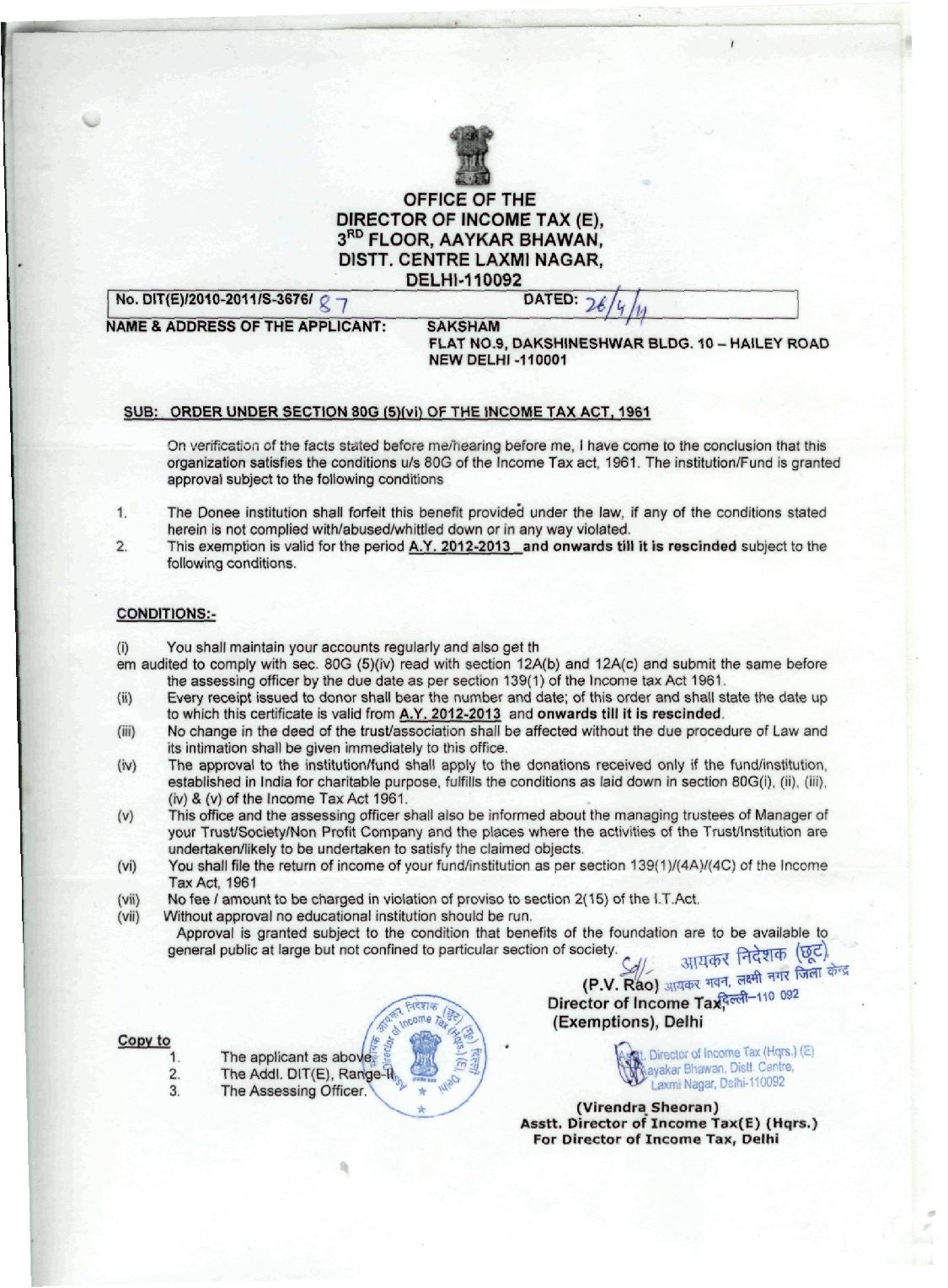

Tax Exemption For Donation Under Section 80G Cash Donation Limit Of

Tax Exemption For Donation Under Section 80G Cash Donation Limit Of

To claim a deduction under section 80G the taxpayer must provide the details of their donations in Schedule 80G in the ITR form as applicable to them This schedule consists of four tables each of which

As per the provisions of section 80G of Income tax Act 1961 deductions are available for donations to certain notified funds charitable institutions or other institutions set up by the Government of India

If we've already piqued your interest in 80g Donation Details Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of 80g Donation Details for various reasons.

- Explore categories like decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- The blogs covered cover a wide range of interests, including DIY projects to planning a party.

Maximizing 80g Donation Details

Here are some unique ways to make the most of 80g Donation Details:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets for free for teaching at-home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

80g Donation Details are a treasure trove of fun and practical tools catering to different needs and pursuits. Their accessibility and versatility make these printables a useful addition to any professional or personal life. Explore the vast world of 80g Donation Details today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are 80g Donation Details really cost-free?

- Yes, they are! You can download and print these materials for free.

-

Can I use free printables for commercial purposes?

- It's dependent on the particular conditions of use. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables might have limitations regarding their use. Be sure to review the terms and regulations provided by the creator.

-

How can I print 80g Donation Details?

- Print them at home with printing equipment or visit a local print shop to purchase premium prints.

-

What software do I require to open 80g Donation Details?

- Most printables come in the PDF format, and is open with no cost software such as Adobe Reader.

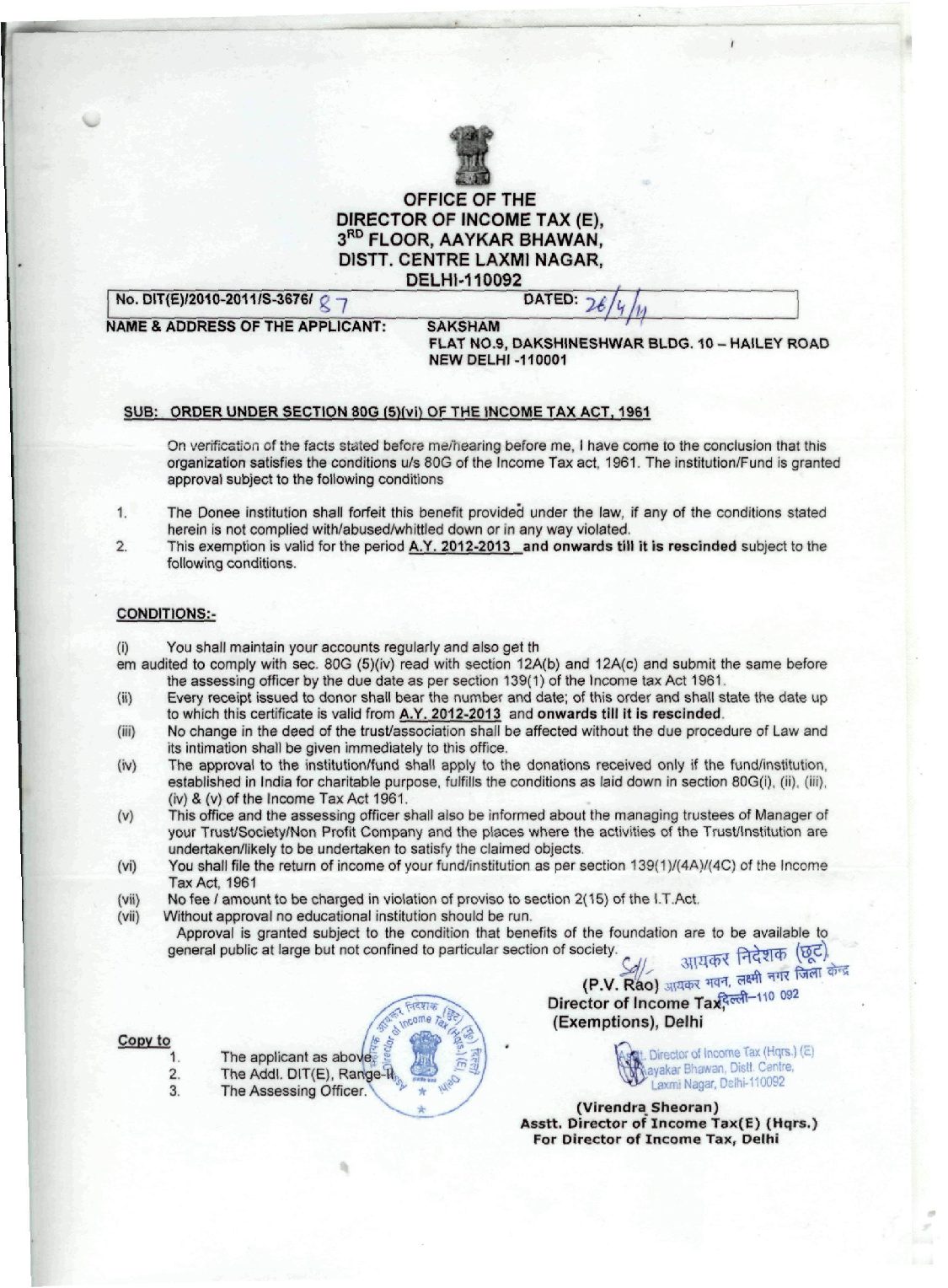

Section 80G Deduction For Donations To Charitable Institutions Tax2win

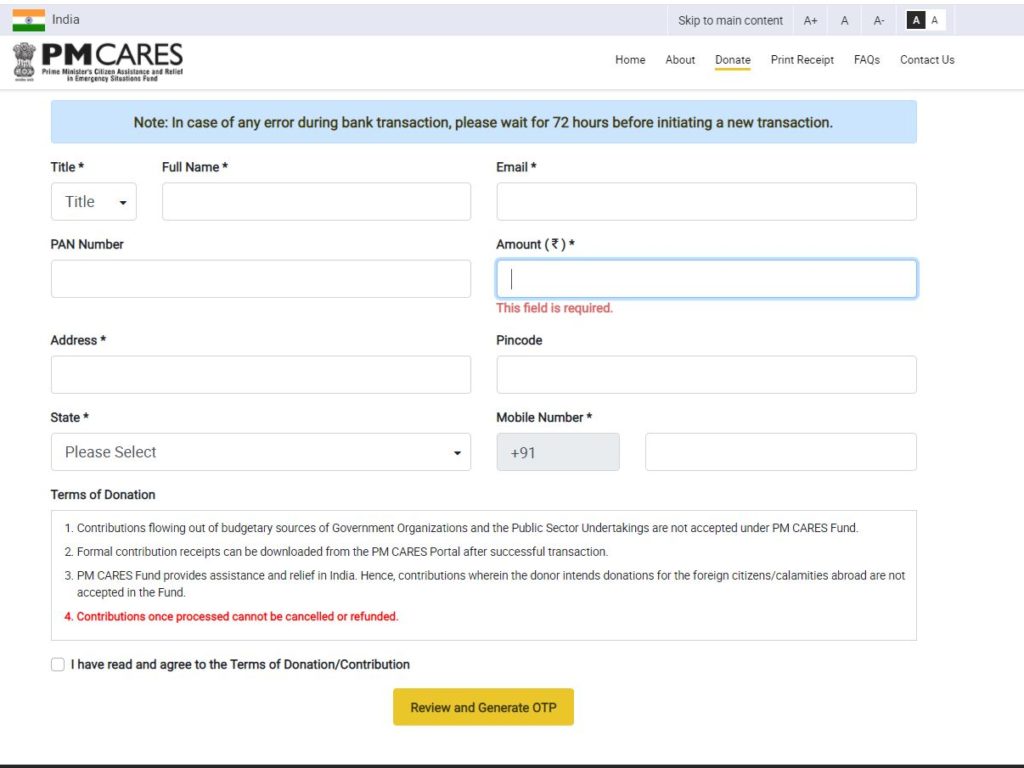

Pm Cares Fund Address Details For 80g GST Guntur

Check more sample of 80g Donation Details below

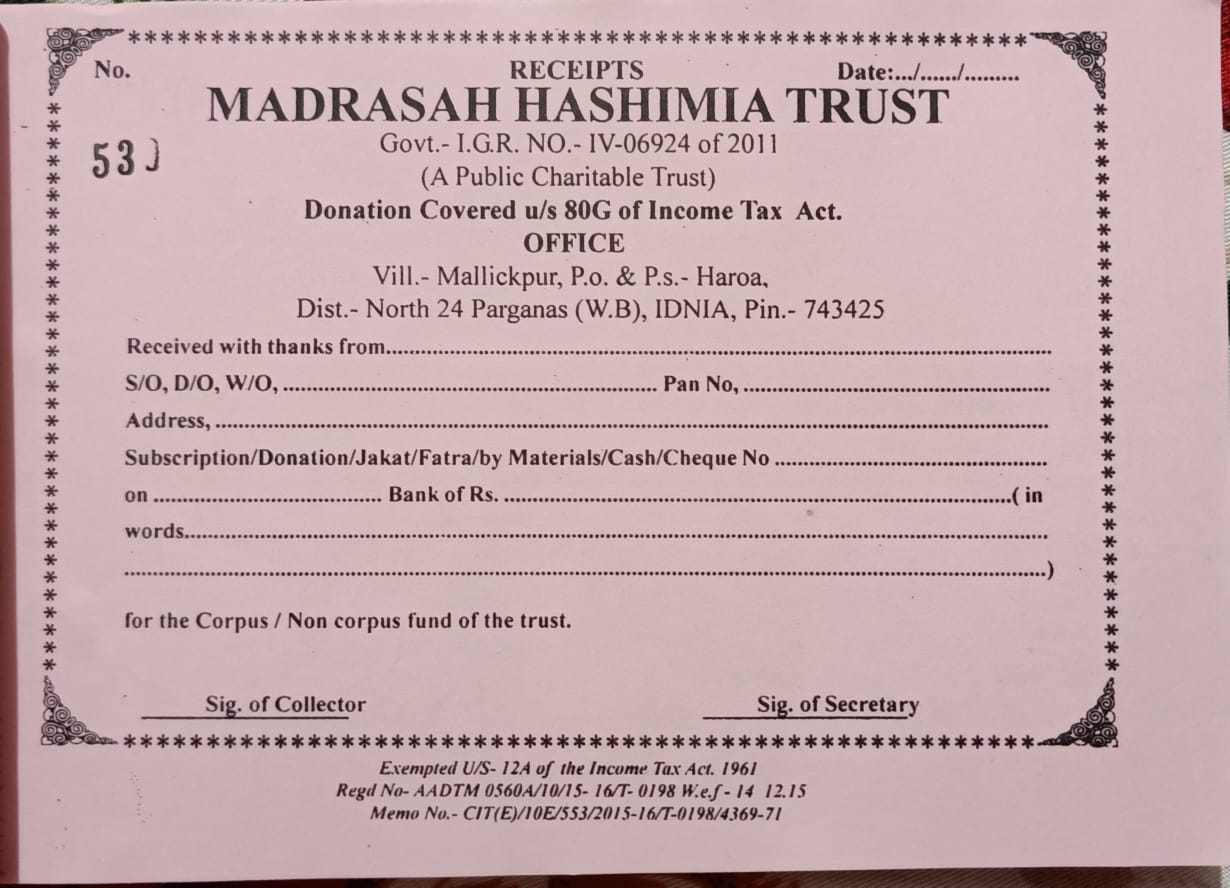

How To Create Donation Receipt On DonationReceipt in For 80G Registered

Section 80G Deduction For Donation To Charitable Organizations

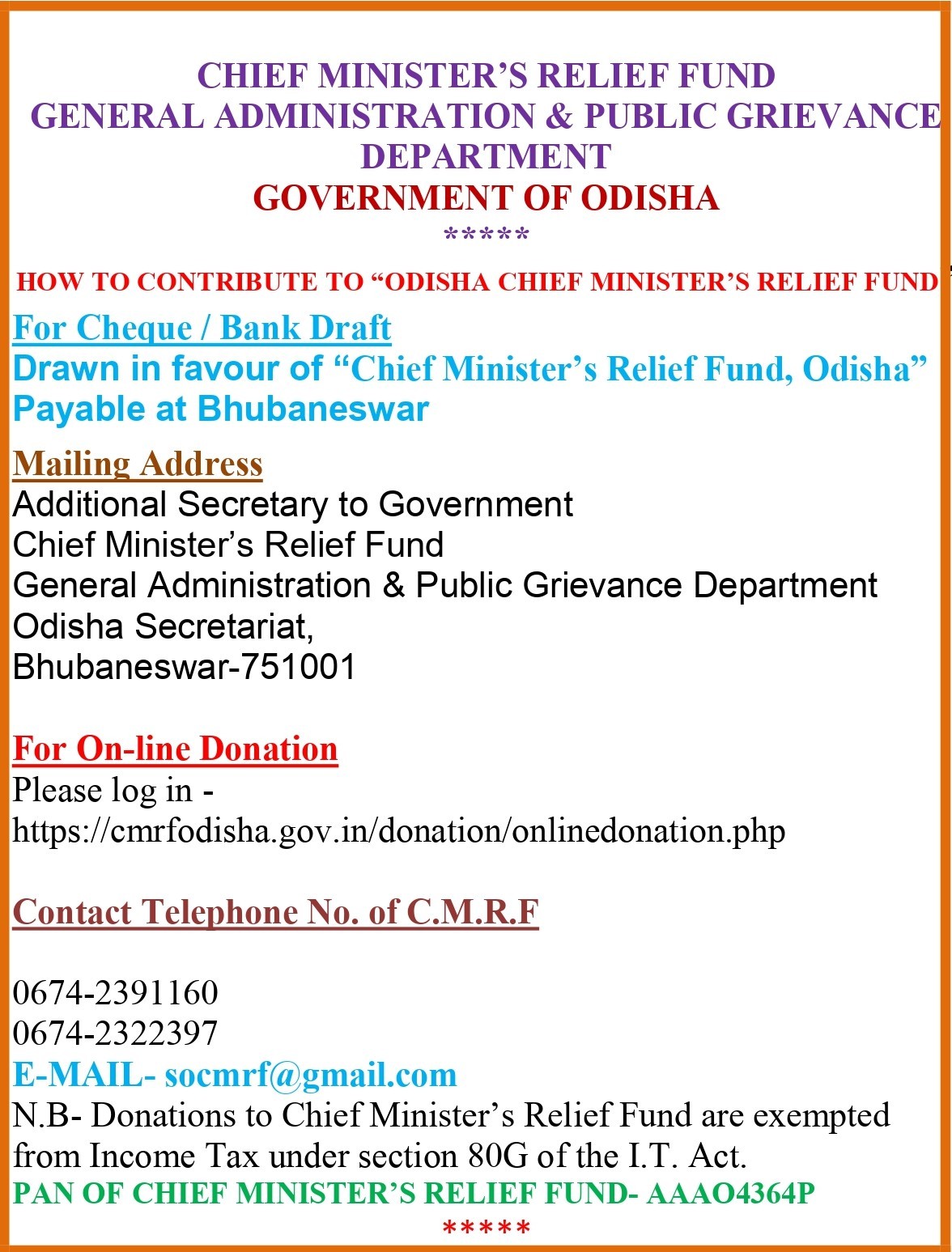

PAN Address Details Of Odisha Chief Minister s Relief Fund For 80G

Online Step To Download 80G Receipt For Donation Made To PM Cares Fund

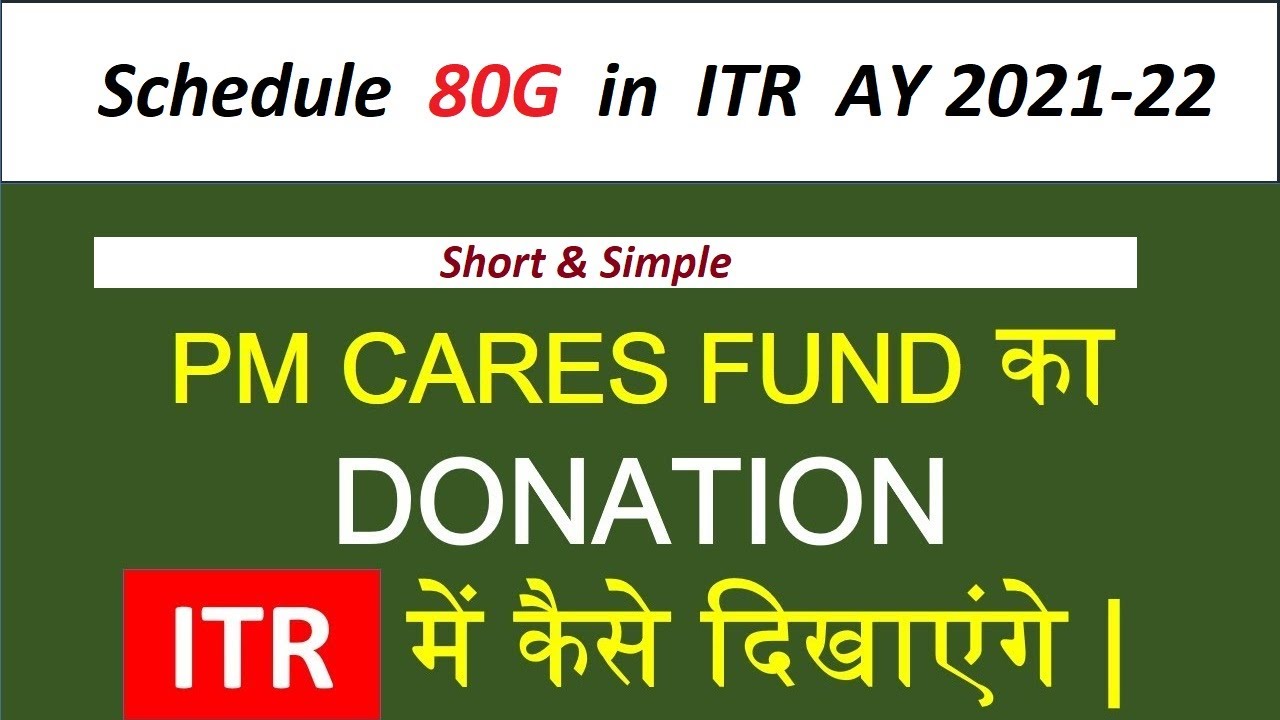

How To Show Donation U s 80G For COVID 19 In ITR AY 2021 22 PM Care

Tax Exemption Under 80G Donation 10BE Form 10BD Donation Return Online

https://taxguru.in/income-tax/all-about-d…

Donations to the following are eligible for 50 deduction under section 80G subject to 10 of adjusted gross total income 1 Donation to the Government or any local authority to be utilized by them for any charitable

https://www.bankbazaar.com/tax/deduction-under-section-80g.html

Section 80G of the Income Tax Act provides tax incentives to individuals contributing to eligible charitable trusts or institutions This section allows for deductions on donations

Donations to the following are eligible for 50 deduction under section 80G subject to 10 of adjusted gross total income 1 Donation to the Government or any local authority to be utilized by them for any charitable

Section 80G of the Income Tax Act provides tax incentives to individuals contributing to eligible charitable trusts or institutions This section allows for deductions on donations

Online Step To Download 80G Receipt For Donation Made To PM Cares Fund

Section 80G Deduction For Donation To Charitable Organizations

How To Show Donation U s 80G For COVID 19 In ITR AY 2021 22 PM Care

Tax Exemption Under 80G Donation 10BE Form 10BD Donation Return Online

Donation Receipt Madrasah Hashimia Trust

Donation Receipt Format Free Download

Donation Receipt Format Free Download

Needed File Online Form No 10BD For Donations Eligible 80G